What are mergers and acquisitions?

Mergers and acquisitions (M&A) refer to the unification of two companies or assets through various financial transactions. Mergers occur when two or more business entities are combined to create a new, joint entity. Acquisitions occur when one entity is taken over by another. Mergers, acquisitions, and divestitures typically encompass numerous types of company restructuring approaches. They can vary based on control, purpose, and other criteria.

There are many reasons for companies to participate in mergers and acquisitions, including:

- Eliminating competitors through an acquisition

- Synergy (companies operating in the same space can leverage each other’s strengths)

- Gaining competitive advantage or a larger market share,

- Diversifying offerings or services

- Cutting costs, etc.

Before undergoing a merger or acquisition, companies should first consider an M&A strategy.

What is an M&A strategy?

One of the best ways to grow and gain market share is through a merger or acquisition. However, M&As are also some of the most daunting deals a firm can undertake. Deals of this size and nature can quickly become a bureaucratic nightmare and are often rife with legal hurdles. Establishing an M&A strategy that focuses on numerous elements, including a fact-based assessment of the current state, analysis and prioritization of potential opportunities, design of the future-state strategy, and an execution roadmap will help your firm through the M&A process.

This comprehensive M&A overview will answer key questions about mergers and acquisitions, including how mergers and acquisitions work and an overview of the different M&A types.

Learn more about how our M&A consultants can support your merger, acquisition or divestiture.

CONTACT USWhat is the M&A process?

The mergers and acquisitions (M&A) process has many steps and can take anywhere from several weeks to several months to complete. Burnie Group has supported multiple M&As from the initial due diligence phase straight through the post-day 1 phase.

Every merger or acquisition involves 5 key phases:

- Due diligence and purchase

- Transition and preparation for Day 1

- Close and Day 1

- Post-Day 1 integration

- Business-as-usual

Our team offers flexible and customizable support to organizations through all five phases of an M&A. Find out more about planning a successful merger with our guide to M&A integration plans and our post-merger integration checklists.

What does an M&A look like?

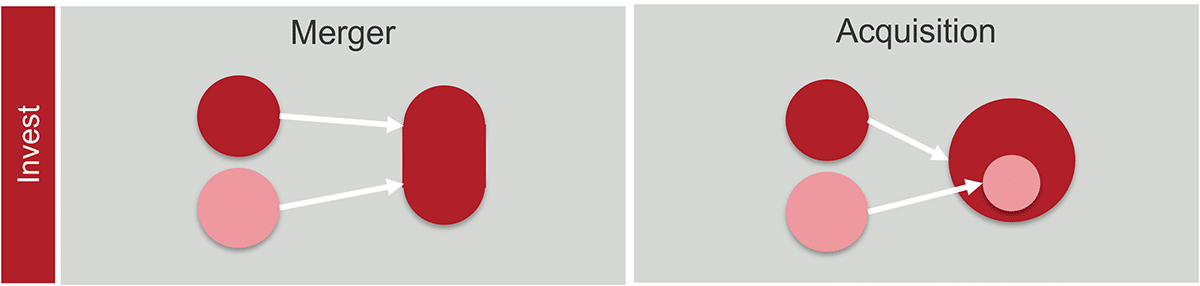

Mergers and acquisitions come in all forms and shapes. In the graphic below, we look at the initial forms that a merger or acquisition can take and provide merger and acquisition examples.

Invest

Merger

When two or more companies merge, they create a new entity that often benefits from both merged parts (e.g. cost position, broader product/services offering, know-how, market access etc.). Numerous types of mergers are described in detail further below.

Acquisition

An acquisition is an extreme merger case where one company takes over another company incorporating it into its own entity.

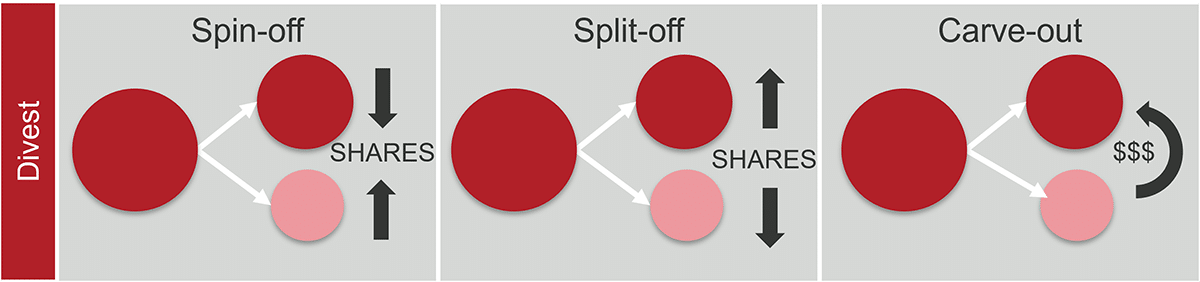

Divest

Spin-off

Companies often spin-off, creating separate entities out of divisions or subsidiaries. As a result of a spin-off, shares of subsidiaries are distributed back to shareholders as a dividend.

Split-off

A split-off is when after separating a company division or subsidiary, the stakeholders have to choose between keeping shares of the original company or changing some (or all) original shares into shares of the split-off company. As a result of a split-off, shares of subsidiaries are distributed back to shareholders as a dividend.

Carve-out

A carve-out is a sale of a minority interest to other companies. Typically the seller is compensated through cash inflow or other financial compensation.

Learn about our mergers and acquisitions consulting services.

READ MORETypes of mergers and acquisitions

Mergers and acquisitions come in all forms and shapes. They can vary by the control degree of an acquired entity or by its purpose. In addition, the M&A type may often dictate the post-merger integration approach and the degree of integration. Below, we expand further on the different types of mergers and acquisitions.

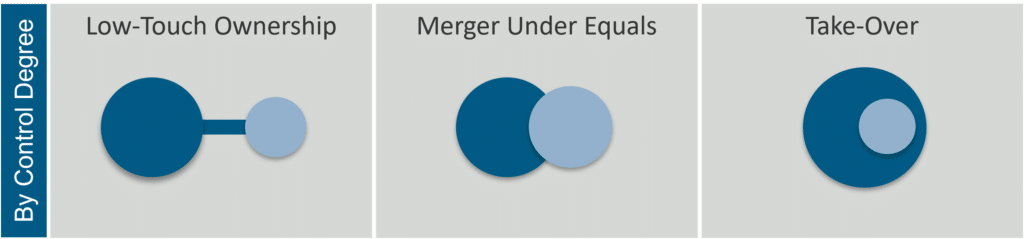

M&A by control degree

Low-touch ownership

A low-touch ownership acquisition is often used to preserve and grow an existing company that performs very well, particularly if it has an independent brand that carries significant value.

Merger under equals

A merger under equals is when both sides bring considerable assets into the merger from a market, product or service, or capabilities perspective.

Takeover

A takeover is an acquisition that occurs when one organization purchases another. Usually, a large company, the acquirer, buys a smaller company, the target. In this case, most of the functions and often the brand are digested by the purchasing company.

Friendly takeovers

A friendly takeover typically means both the buy-side and sell-side companies are in full agreement about the deal. In this case, the integration process has a much higher chance of success because both sides work together towards the same goal. These integrations are characterized by easy access to data, collaborative work, sharing best practices, and minimal hidden traps. Friendly takeovers can also be mutually beneficial for the acquirer and target company.

Hostile takeovers

A hostile takeover means the takeover happens against the will of the company owner or management, and there is a misalignment in the deal terms. In this case, the integration process is more difficult because of limited access to data, especially before Day One, non-collaborative work, potential attrition of key employees if the previous management decides to take them on a new endeavour, and not sharing best practices.

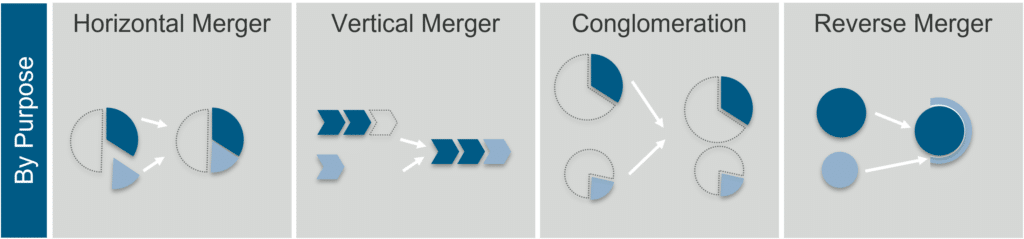

M&A by purpose

Horizontal merger

A horizontal merger is a merger or acquisition of a company that competes in the same space in the value chain. The main goal is to increase market share, drive economies of scale, or increase presence in other geographies.

Vertical merger

A vertical merger is a merger or acquisition of a company so that both companies complement one joint value chain.

Conglomeration

A conglomeration is an acquisition of or merger with a company that is active in a partly or entirely different space. These can be mixed or pure conglomerate mergers.

Reverse merger

A reverse merger is an acquisition of a public company via a private company to use the public company as a shell. By merging both companies, the private company becomes public without IPO. A reverse merger is a cheaper and faster alternative to making a company public.

How our post-merger integration services can help you

Many mergers and acquisitions fail to deliver on expected benefits. Integration of any merger or acquisition should be planned and executed with accuracy and precision to deliver the expected benefits. The heavy lifting of an M&A comes after the deal closes.

Our PMI experts have extensive experience in setting up integration governance, putting in place the structures required for successful integration, working hand-in-hand with your teams to define all elements of the target state in detail, and executing this plan. Simultaneously, we will make sure that you deliver on estimated benefits and extract the value of your M&A deal.

About the author

Alexey Saltykov

Find out how our M&A specialists can support your mergers and acquisitions.

CONNECT WITH US