What is a post-merger integration?

A post-merger integration (PMI) occurs when two or more companies complete a merger or acquisition. PMI is a complex process of combining and rearranging the merged companies into one operating model while optimizing every benefit of the merger. The degree of integration varies by the transaction.

Why do you need a post-merger integration plan?

A post-merger integration plan, also known as a merger and acquisition plan, can help companies solve problems that arise during a merger. The following are four reasons to create a PMI plan.

- Ensure proper preparation before Day 1: Shaping a successful merger starts the moment you make a deal. An integration plan determines the tasks you must complete before Day 1. There are many concrete steps to prepare for Day 1, from defining the organizational structure of the merged company to the communication plan and much more.

- Create an hourly step-by-step plan for Day 1: A step-by-step plan organized by the hour is integral to a successful M&A plan. Day 1 is the first opportunity that all employees of both companies have to meet and interact, so everything must happen as smoothly as possible.

- Ensure the right course of action for all integration activities: A successful post-merger integration is the product of highly detailed planning. An acquiring company must plan many activities in advance of a merger, some of which may require both an interim and target state. Not having a proper project plan poses many risks, such as high attrition, IT incompatibility, brand dilution, and conflicts of responsibility.

- Ensure the value associated with the PMI is extracted: It is nearly impossible to extract any planned benefits from a merger or acquisition without careful planning. It does not matter if the benefits originate from platform consolidation, cross-selling, geographical or industry expansion, or cost improvement; any of these sources of value require careful planning.

Read everything you need to know about the mergers and acquisitions process.

READ MORETimeline of key milestones in a post-merger integration plan

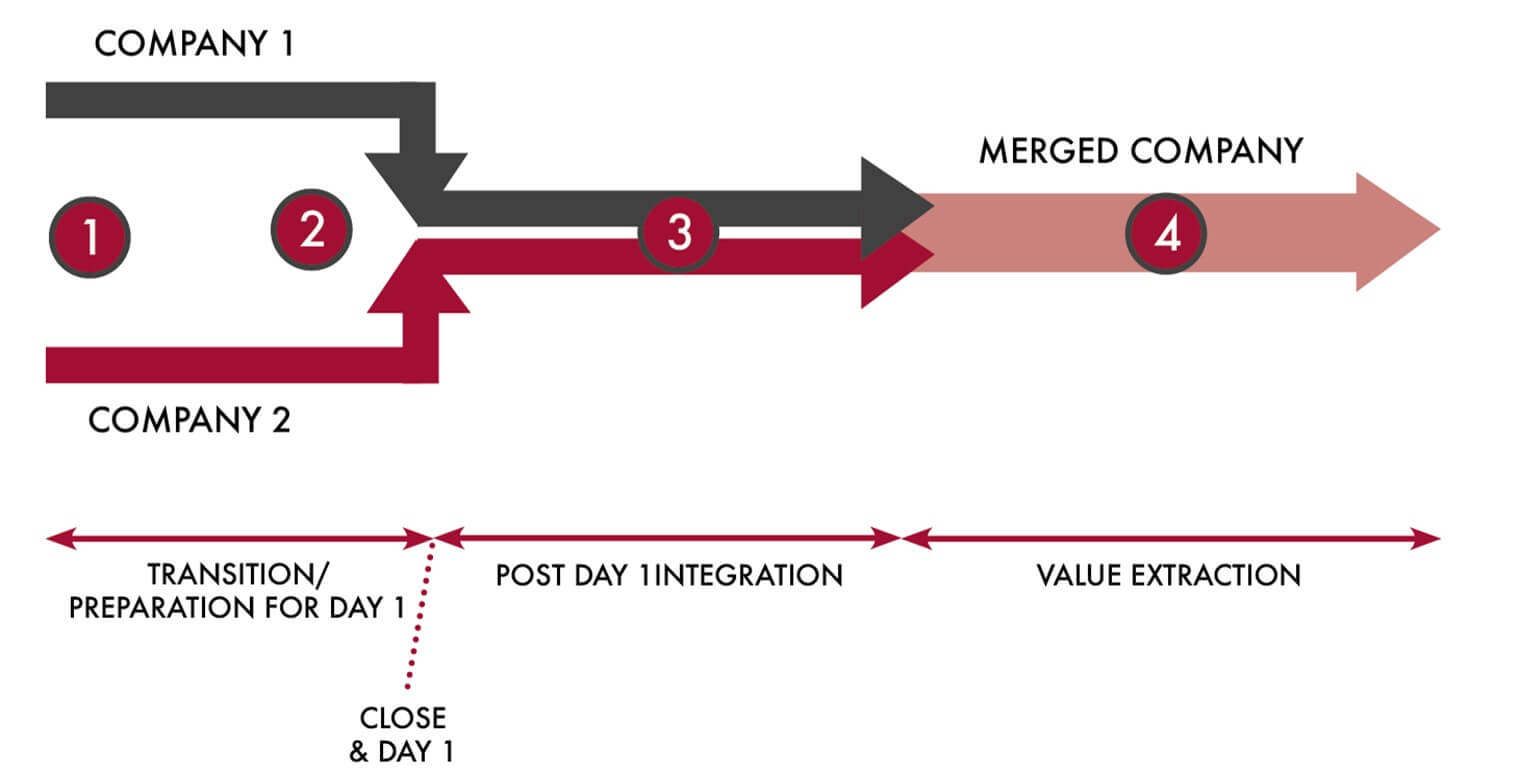

A merger and acquisition (M&A) integration plan starts with identifying significant milestones. The sample integration plan below shows typical deal milestones with a post-merger integration timeline and examples of deal-specific milestones.

Some milestones are typical for all integrations, whereas others can be deal-specific. Here is an overview of key milestones by phase for a typical M&A integration plan.

Pre-due diligence

Pre-due diligence can take place either well in advance or immediately before due diligence and signing. The objective is to research the market and identity and narrow down a list of potential acquisition opportunities. Ideally, this phase ends in identifying a potential acquisition target.

Due diligence & signing

Once a company identifies a merger or acquisition target and both sides have expressed a potential interest, the due diligence stage begins. First, the potential buying company focuses on collecting all the necessary data about the company to be merged or acquired. Then, if due diligence outcomes align with the buyer’s expectations, this phase ends with contract signing. The contract lays out the potential buyer’s intention to buy a company or a part of it.

Transition & preparation for Day 1

Several deal-specific milestones might need to occur throughout the transition and preparation for the Day 1 phase. For example, if a deal involves at least one public company, the company might require a public announcement to inform shareholders and the general public about a potential transaction. In this case, integration planning must include a shareholder vote to ensure a deal can proceed as planned. The deal might also require regulatory deal approval depending on the industry, deal size, or other external factors.

Closing and Day 1

In many integrations, Closing Day, when the deal is finalized and funds are transacted, and Day 1, the first publicly known day of a company operating as an integrated whole, occur on the same date. Nevertheless, there are situations when these milestones occur on different days, such as around public holidays.

Post-Day 1 integration

Post-Day 1 Integration Typical post-Day 1 integration plans include 30, 60, 90, and, sometimes, 100-day milestones. In addition, there are many integration-specific milestones by workstream.

There is often a target milestone for official integration completion, though some parts of an integration may proceed beyond it, such as integrating larger IT platforms andsolutions. As the integration of a company progresses, more departments and business units start operating in a business-as-usual mode.

Business-as-usual

Once all the key projects related to integration are completed, the majority of the company operates as a fully integrated entity. Business-as-usual is sometimes considered an unofficial milestone for full integration completion.

Read everything you need to know about the mergers and acquisitions process.

READ MOREPost-merger integration considerations

Building an actionable and comprehensive post-merger integration roadmap or plan requires time and integration experience. The most successful mergers have a merger integration roadmap that combines an effective upfront strategy with pre-merger planning and post-merger integration. These three components are critical for success:

- A solid strategy outlining the company’s plans and objectives and how the merger or acquisition fits into that ensures that the right targets are set.

- A strong pre-merger plan that looks at companies with the right capabilities to build trust among those involved and works through the deal effectively from the start of the integration.

- A post-merger integration project plan that looks to capture value as quickly as possible. The post-merger integration planning can include a target operating model and a technology strategy plan.

The complete list of critical aspects for a successful merger or acquisition is longer and spans various organizational areas and themes. Below is a checklist you can use to get started:

Content

- Depth: Develop content with enough detail to guide integration execution.

- Breadth: Cover all functions within the organization.

- Clarity: Write concise descriptions of integration activities with tangible outcomes.

People

- Team: Establish one central team managing the entire integration.

- Roles: Establish clear roles and responsibilities for all integration activities.

- Involvement: Involve all relevant team members from the acquired company. Involve team members from the acquired company as needed.

Technology

- Repository: Develop a centralized repository of all integration planning aspects.

- Reporting: Enable on-demand reporting about integration progress.

- Ease of use: Ensure all tools used for your PMI management are easy to use and suitable for all team members.

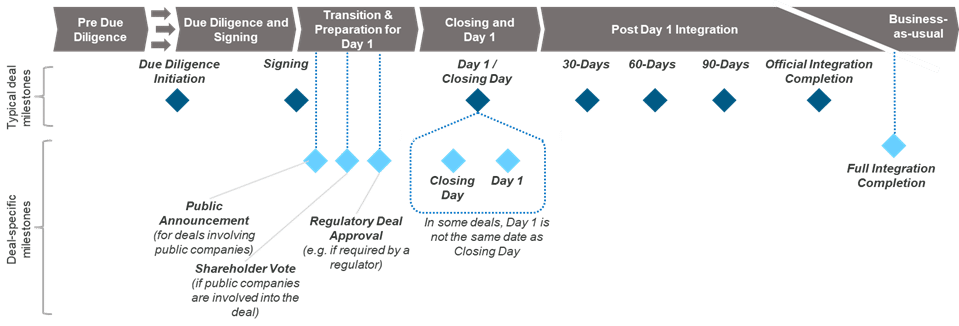

How post-merger integration timing impacts your plan

A well-designed post-merger integration plan is essential for a successful closing. An organization must plan for a post-merger integration during the pre-closing period because the time available before Day 1 dictates the work that can be completed. Consequently, the organization must triage tasks based on importance and time available.

The most critical tasks for an aggressive, accelerated, and relaxed integration timeline

Aggressive timeline

- Immediate focus on critical activities required to close the transaction (e.g., legal and finance)

- Communicate with key internal and external stakeholders, including staff of both companies

- Setup the Integration Management Office (IMO) and integration workstreams

- Address the most urgent people-related themes

- Plan for few changes on Day 1

- Create a Day 1 run of play

Accelerated timeline

- All activities from the aggressive timeline

- A more thorough assessment of personnel and key employees

- High-level understanding of the operating model of the acquired company

- Potentially, a design of Day 1 organization structure

- Begin to understand the status quo in the acquired company

- Plan for minimal changes on Day 1

Relaxed timeline

- All activities from the aggressive and accelerated timelines

- More thorough understanding of the operating model of the acquired company

- Design elements of the target operating model for the integrated company

- Plan for several changes on Day 1

If timing is tight and only a few weeks are available before the close, pre-closing activities must focus on crucial legal, financing, communication and people-related topics. If there are four to six weeks to the close, a more thorough integration planning process can occur for all the workstreams, not just the most crucial Day 1 workstreams. With even more time available, organizations can also design a target operating model for the combined organization.

Read our 15 tips to ensure a successful post-merger integration.

READ MORETypes of post-merger integration plans

1. Gantt chart

When developing post-merger integration plans before closing and in the first 30 days after Day 1, plans are developed with attention to detail to ensure that all time-critical activities are remembered. Detailed post-merger integration plans in Gantt chart form are often used.

- Draft Gantt charts for each integration work stream (ideally, based on available integration plan templates).

- Include all relevant activities to ensure that nothing is forgotten.

- Include enough detail to provide clear guidance for all parties involved in the integration.

- Our visual reporting tool enables you to recognize issues easily.

- Reports are generated in an automated way based on workstream project plans.

- The reporting tool combines both quantitative and qualitative insights

2. Milestone plan

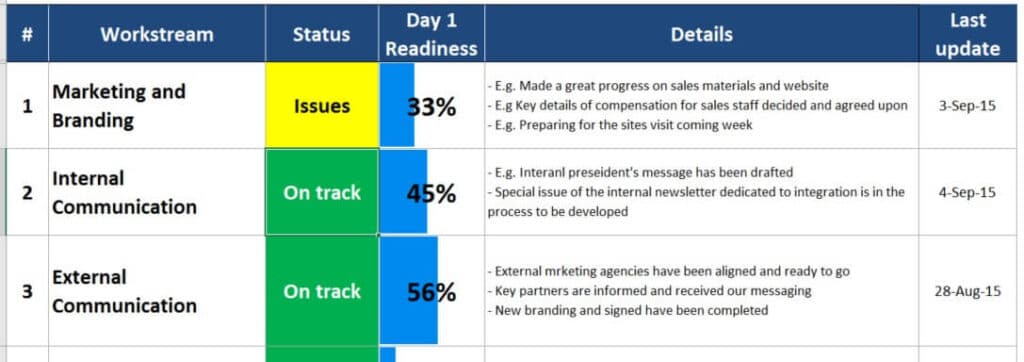

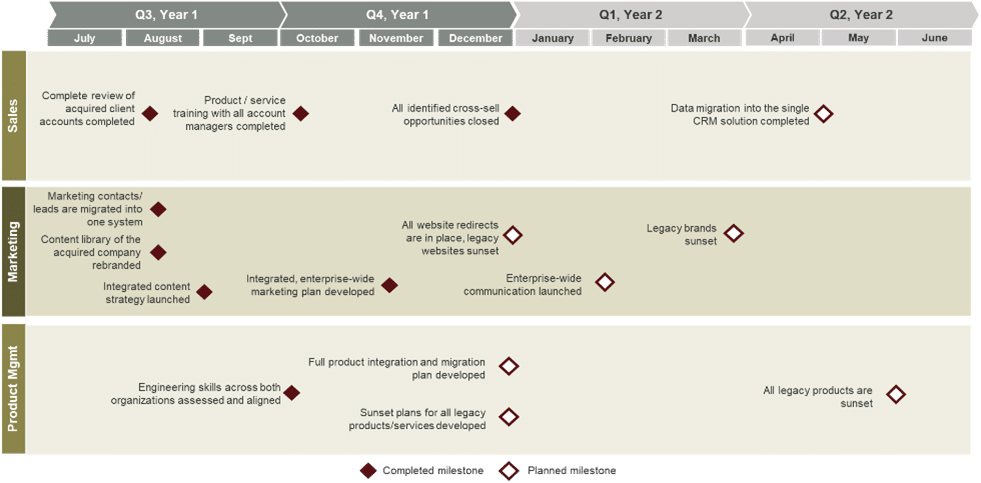

Often post-merger integration plans are developed on the milestone level, especially after the first 30 days. That enables a higher level of planning. Here is an example of a post-merger integration timeline with a few workstream-specific milestones.

- A milestone plan is typically developed on a monthly or quarterly level

- Instead of focusing on activities, a milestone plan focuses on critical milestones.

- The plan differentiates between planned and completed milestones.

Integration planning and dependencies

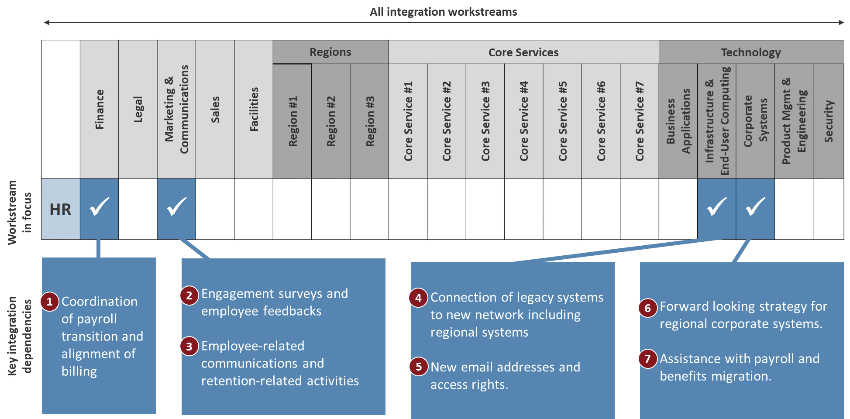

Integrations are complex because they are transformational projects that cross most areas of an organization. Therefore, integration plans must align with all relevant workstreams by identifying and considering critical dependencies.

An example below highlights six critical dependencies of an HR integration workstream with other organizational areas, including payroll, billing, employee communication and corporate systems such as a human resource information system (HRIS).

While critical dependencies are typically captured and tracked, additional, less-critical dependencies also might exist. The dependencies should be regularly reviewed and evaluated in cross-workstream meetings. We recommend a visual format.

We typically differentiate between industry-agnostic areas such as HR, Finance, Procurement, Legal, Marketing, and Sales. These workstreams are often broken into specific functions. For example, the IT workstream can break down into Applications, Infrastructure, End-User Computing, Security, and IT Governance.

Other areas might differentiate from industry to industry – here are some industry-specific examples:

- Insurance: Underwriting, policy administration, claim management

- Tech-enabled services: Account management, processing, service-specific processes (e.g. analytics, hosting)

- Manufacturing: Supply management and logistics, manufacturing, quality assurance

- Senior Living (including retirement living, long-term care, and skilled nursing facilities): Clinical, operations, asset management

- Cannabis industry: Research and development (R&D), sourcing, cultivation, processing, testing, packaging

It is also important to include all of the sales and service channels, whether they are proprietary or 3rd party. These may include:

- Physical channels: Facilities, branches, shops, mail centers, archive centers

- Digital: Online, mobile

- Phone: Call centres, chat

- In-person: Advisors, agents, consultants, brokers, etc.

- Any industry-specific channels

It is helpful to start the project with a clear view of all critical activities and post-merger integration checklists by workstream to hit the ground running. For example, Burnie Group has a proprietary database of integration plan templates based on thousands of integration activities and milestones by workstream and types of integration to ensure that all key integration activities are included.

Read our comprehensive post-merger integration checklist.

READ MOREMistakes to avoid in a post-merger integration plan

There are several mistakes while developing a post-merger integration plan – below, we’ve listed a few:

Content

1. Excluded areas: No area should be excluded from a PMI plan. Even if an area doesn’t require any changes, you should highlight this in the plan.

2. Missing the target state: If there is no common understanding and alignment on the target state, your PMI will likely not deliver on the promised benefits.

3. Too high-level: Not designing a PMI plan and target state deep enough means that much of the work will need to happen later, requiring a higher effort to enable change.

People

1. No central PMO team: Lacking a dedicated central team to oversee and guide PMI can hinder the integration’s success.

2. Unclear roles: Even a clearly defined PMI plan with all associated activities will not be successful without the clear assignment and tracking of responsibilities.

3. Lack of communication: Not sharing your PMI’s target state and vision will leave staff unmotivated to enact change. People need a clear picture of the destination.

Technology

1. De-centralized approach: Using various PMI plans that are not available centrally can cause confusion among the workstreams.

2. Too complex: A tool-heavy execution that employs complicated project management (PM) tools might be inefficient as you have to account for the learning curve of the PM tool.

3. Lack of reporting: Lack of or inaccurate reporting will limit your ability to follow the progress of the PMI project.

How can our post-merger integration services help you?

Interested in getting more guidance around your post-merger integrations? Our PMI specialists have over ten years of experience assisting clients in their M&A activities. Contact us for an initial discussion and assessment of your situation. Burnie Group’s specialists are happy to have a no-obligation discussion with you about the post-merger integration process, roadmap, and what makes mergers work.

About the author

Alexey Saltykov

Find out how we can support your acquisition or integration project.

CONTACT US