While each post-merger integration (PMI) is different, many elements are consistent no matter the size or nature of the transaction. Checklists can guide your integration whether you are executing your first integration or face multiple integrations per year. In addition, they can help your organization to ensure everyone knows what to do for each workstream and stage of the integration to ensure you don’t miss anything in the planning process.

This article provides a starting point to organizations beginning their PMI journey. It highlights the most important topics to consider at each stage of an integration, along with checklists to build upon as PMI plans are created.

- Post-merger integration checklists for Phase 1: Preparation for Day 1

- Post-merger integration checklists for Phase 2: Day 1

- Post-merger integration checklists for Phase 3: First 30 days

- Post-merger integration checklists for Phase 4: 30-90 days

- Post-merger integration checklists for Phase 5: Post 90 days

- Post-merger integration checklists by area

Structuring post-merger integration checklists

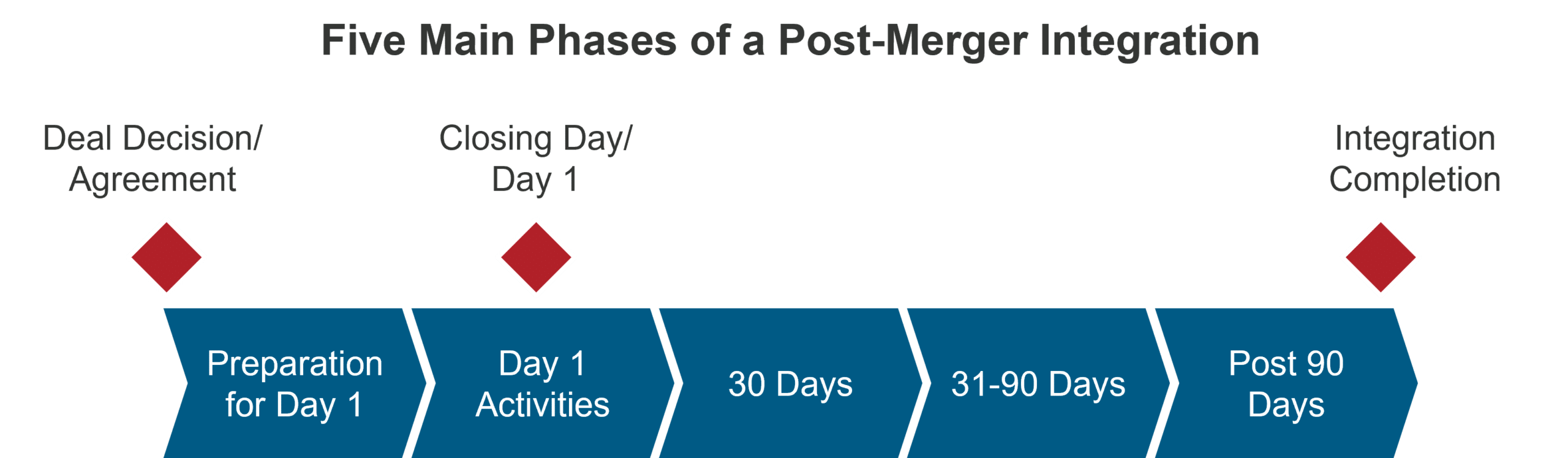

Our checklists offer a starting point for the main activities for workstreams during each phase an integration. A PMI has five main phases:

- Preparation for Day 1

- Day 1 Activities

- First 30 Days

- First 90 Days

- Post 90 days

Post-merger integrations involve many different workstreams, some consistent across all organizations and some unique to the business. Workstreams are responsible for planning and carrying out the activities required to integrate their specific area.

While our integration checklists offer examples of typical integration themes, they aren’t comprehensive or specific enough to be the only source of guidance for your integration. Burnie Group helps our clients design a set of PMI activities tailored to their organization at the right level of detail.

Learn about the most essential tasks for an integration based on your timeline.

READ MOREPost-merger integration checklists for Phase 1: Preparation for Day 1

During the pre-close period, the key focus must be on the crucial tasks necessary for a successful close. These critical tasks generally fall within the Legal, Finance, People (HR) and Marketing & Communication workstreams. While planning and preparation can and should be carried out in the other workstreams, they are generally not immediately urgent.

During this period, the Legal and Finance workstreams should focus on the mechanics of the transaction. They must ensure funding is organized, the corporate structure is correct, transaction documents are reviewed, and any jurisdictional nuances are considered. For the People and Marketing & Communication workstreams, the focus must be on positive messaging and keeping all stakeholders well informed. Uncertainty and apprehension are present for all integrations but strong communication and people management can minimize the downside. The People workstream should also identify and retain key employees in this stage.

Governance and Integration Management Office (IMO)

- Set up integration governance, including definition and communication of responsibilities

- Develop the key PMI principles by which to run the integration

- Set up integration workstreams

- Develop a list of Day 1 must-do and nice-to-have activities

- Put in place governance mechanisms including integration tracking, reporting, issue management, risk management, etc.

- Develop a high-level integration roadmap

- Ensure proper integration planning and workstream support

- Support evaluation of needs for Transfer Services Agreement (TSA)

- Ensure that TSAs are in place if required

- Develop logistics for Day 1

- Get perspectives on the key sources of integration benefits (e.g. design changes, consolidation of IT systems)

- Set up an initial baseline for benefits realization

Legal

- Understand the current legal organizational structure of all entities and design an interim legal structure

- Gain clarity over ongoing and past material litigations, as well as any representations and warranties provided by the sellers

- Gain clarity on all IP, including patents and trademarks and their ownership and expiry

- Conduct an insurance gap analysis

- Understand any immediate impact on customer contracts and MSAs

- Understand key vendor contracts, including break clauses and associated fines and penalties

- Ensure all regulatory obligations and requirements are met and all necessary regulatory approvals are received

Finance

- Finalize initial consideration and closing schedules

- Raise, organize, and transfer required capital and funds

- Prepare closing financial statements

- Start planning for interim billing, cash application services, and collections structures

- Build on financial analysis conducted during due diligence to model expected synergies and financial impacts of the transaction

People

- Obtain complete staff lists, including full-time, part-time, casual, on-leave staff, and contractors

- Understand existing payroll approach, and start planning for an interim and target approach

- Understand existing organizational structure and design a Day 1 top-level structure

- Understand benefits package and ensure no interruption of benefits during the transition period

- Assess key personnel to identify those who should be approached for reassurance discussions and to fast-track new contract issuance and retention packages if required

- Understand the key elements of any union contracts and labour relations that may exist

Marketing and Communications

- Prepare an employee messaging framework for staff from all organizations and tailor it as required

- Prepare internal messaging for employees, board, and other stakeholders

- Prepare external press releases for the broad market, key publications, partners, associations, and regulators

- Prepare external customer notification guidelines and communications

- Prepare all the necessary welcome materials (e.g. Q&A, FAQs, leadership messages)

- Schedule and prepare materials for a joint town hall

Technology and IT

- Plan for the continued support of the current technology stack from Day 1 onwards (e.g. helpdesk)

- Evaluate any potential areas for a security breach (e.g. manage access rights, etc.)

- Plan for frictionless collaboration and communication between employees (e.g. email, data exchange and storage, communication and collaboration tools such as video conferencing

- Ensure continued access to current systems and technology

- Get an initial perspective on the technology landscape, if possible

All workstreams

- Provide required inputs for the welcome materials and Q&A

- Maintain operations throughout the transition

Post–merger integration checklists for Phase 2: Day 1

Day 1 is a unique opportunity for the company that drives the integration to make an impression on its new employees and set a tone for the future work together. It is the first true opportunity to connect with the entire team of another organization, alleviate any concerns, and inspire the teams. This is why you must plan for Day 1 well in advance with hourly plans for all essential activities. There are a few key activities that need to happen on Day 1.

Governance and Integration Management Office (IMO)

- Support Day 1 execution, including logistics

- Capture, triage, and address any issues raised throughout Day 1

Legal

- Meet all necessary contractual items and conditions

Finance

- Complete the transfer of all funds

- Get access to the acquired entity’s bank accounts and financial systems

People

- Hold key personnel meetings with those who have not been involved with the transaction to-date

- Ensure that new contracts are signed by employees if required

- Get full access to personnel data and key HR systems (e.g. HRIS, payroll, etc.)

- Initiate and introduce any support programs for new staff, such as buddy program (this may occur before Day 1)

Marketing and Communications

- Announce Day 1 CEO

- Hold employee town hall(s)

- Distribute welcome materials and Q&A

- Distribute press releases

- Distribute key customer communications

- Conduct in-person site visits

Technology and IT

- Make necessary Day 1 changes (e.g. enable new email domain if required)

- Transition key access data for all systems (e.g. access rights)

- Ensure continued access to existing systems and tools

- Enable frictionless collaboration and communication between employees (e.g. email, data exchange and storage, communication and collaboration tools such as video conferencing etc.)

- Ensure helpdesk and support services are still provided through the Transfer Services Agreement, the new organization or the old organization

All workstreams

- Connect the heads of corresponding areas and staff participating in the buddy program

- Provide personal welcomes and coordinate meetings between new colleagues

Post-merger integration checklists for Phase 3: First 30 days

Depending on how early the PMI process begins before the transaction’s close date, the work involved in this phase can sometimes begin before the Closing/Day 1. Generally, this work is conducted within the first 30 days post-close. This phase involves understanding and maintaining the current state while capturing best practices across both organizations and gaining further insights into sales and financial numbers. The whole organization does not magically change operations when the transaction is complete. Instead, the organization must maintain the status quo while the integration is planned in detail – both the interim state and the target end-state.

While all workstreams should be engaged in planning, the People and Technology workstreams must stay on top of changes occurring across the organization, making sure systems are still functioning as required and people can complete their work and training as needed.

Governance and IMO

- Plan and support discovery sessions across workstreams

- Complete all the key 30-day activities

- Track and report integration progress

- Track and report integration benefits

Legal

- Implement necessary legal changes (e.g. new contract templates, compliance policies)

- Provide necessary legal support as needed

Finance

- Ensure no disruption to the cash cycle (e.g. billing, accounts payable, accounts receivable)

- Review budgets and financial forecasts for the coming period(s)

- Develop interim reports for the combined business

People

- Gain an understanding of the top and bottom performers across the new organization, and compare with your own resources

- Design an interim organizational design and a high-level view on a target state org design

- Track key people metrics related to the integration (e.g. attrition, employee satisfaction)

- Ensure that the initial payroll in the integrated organization is executed frictionlessly, including a plan B if needed

Marketing and Communications

- Ensure communication continues with staff at a regular cadence (e.g. regular town halls and integration newsletters)

- Gain an overview of any current marketing campaigns and projects underway

- Implement necessary website changes (e.g. co-branding, announcements for clients, new contact numbers)

- Develop an initial perspective on the target branding and client-facing elements

Technology and IT

- Ensure all onboarded staff have access to the systems they need

- Gain an overview of any current technology projects underway

- Ensure that essential technology collaboration pieces work frictionlessly (e.g. email, data sharing and storage, video conferencing, calendaring)

- Implement an initial wave of technology changes according to the integration plan (e.g. switch over emails, provide standard equipment to the added employees)

- Conduct security audits in the new organization

Sales and Distribution

- Work with the Marketing & Communication workstream to ensure client communications are occurring as needed

- Understand the pricing model and sales terms

- Create and update the interim sales budgets and forecasts

- Understand each organization’s customer lists and any overlap

- Understand areas of product overlap

Operations

- Understand all Research and Product Development projects that are planned and underway

- Understand inventory systems and processes at every location

- Conduct site audits to confirm inventory figures

- Review current operations processes according to the industry

Vendor Management and Procurement

- Understand all supply contracts and relevant vendors across the organizations, and review terms

- Understand and validate savings opportunities (e.g. from combining similar contracts)

- Initiate (re-)negotiations with vendors and start signing new contracts

- Align on Procurement procedures

All workstreams

- Conduct discovery sessions to understand the current state and capture and exchange best practices

- Maintain the status quo

- Develop interim state designs

- Initiate target state designs

- Provide tracking and reporting of PMI progress for each workstream

- Identify, track and mitigate PMI risks

- Track the realization of PMI benefits

Post-merger integration checklists for Phase 4: 30-90 days

For the period between 30-90 days post-close, the integration shifts from maintaining the status quo to implementing the interim organizational state. For some areas of the organization, this interim state may be the final target state. For others, the interim state is about implementing technology, procedures, and workflows to enable the organization to continue functioning and operating while the target end-state is designed.

Governance and IMO

- Support the implementation of interim states across the organization

- Facilitate alignment workshops to ensure timelines and priorities are stress-tested and socialized between workstreams and across the organization

- Complete all key 60 and 90-day activities

- Track and report on implementation progress and synergies achieved

Legal

- Manage any conflicts of interest and contractual terms identified

- Consolidate insurance coverage

- Evaluate the legal entity structure for possible rationalization

Finance

- Map entity trial balances and consolidate financials, budgets, and reporting as required

- Conduct evaluations to determine the financial system to be used in the target state

- Prepare reports and financial information required to meet any covenants associated with transaction financing

- Work with the IMO workstream to track synergies and other implementation financial metrics

People

- Manage the first round of staff turnover, both planned and unplanned

- Work with other business areas and workstreams to plan for upcoming staff movements as the organization moves to the interim state and then target state

- Conduct evaluations to determine which HRIS system to use in the target state

- Evaluate benefits providers and work to understand what the target state for benefits will look like

- Define any changes in target processes (e.g. recruitment, onboarding, learning and development)

- Address any issues related to labour relations topics (e.g. via discussions with unions, if applicable)

Marketing and Communication

- Implement the branding changeover, interim branding, and sunset of old branding and collateral

- Work with IT to close and redirect prior websites to the new website

- Review and merge contact databases

- Combine the collateral used for marketing

Technology and IT

- Begin technology evaluations and comparisons between comparable applications

- Identify target states for key clusters of applications (e.g. HR, Finance, Operations, Sales)

- Merge data centers and ensure network connectivity at all physical locations

- Deploy standardized security across the acquired organization

- Complete any urgent upgrades and implementations to fix gaps in the technology landscape

Sales and Distribution

- Allocate responsibilities for shared clients

- Establish territory and channel conflict procedures

- Develop and adjust pricing as needed

- Develop aligned compensation models (e.g. commissions, salaries for the sales and distribution team)

- Conduct CRM evaluations to determine which system to use in the target state

All workstreams

- Implement interim state designs

- Further and finalize target state design

- Identify and capture benefits within each workstream

- Provide synergy capture information to the Governance & IMO workstream

Post-merger integration checklists for Phase 5: Post 90 days

The final phase of the transition generally takes place from the 90-day mark. The focus for all workstreams is on implementing the integrated target end-state. Workstreams have adequately planned and prepared, designed the target state based on the combined businesses strategy, and taken best practices from both organizations to create the optimal way of working for the unified organization. At this stage, significant changes begin happening in the combined organization; the companies start to implement large process alignments, consolidate their IT, ERP, and HR systems, and make decisions on off-shoring and outsourcing, automation, and digitization. In short, companies implement the changes required to fully capture the synergies and benefits of the transition, positioning the new organization for strong future performance.

Governance and IMO

- Support the implementation of target states across the organization

- Close off workstreams and associated reporting as integration efforts complete in their areas

- Complete all key integration activities

- Track and report on implementation progress and synergies achieved

Legal

- Roll out the target state for legal policies and procedures

- Implement any entity rationalizations required

Transfer all contracts and IP to the target legal entity

Finance

- Implement the chosen finance system

- Finalize the closing financials at close-date

- Consolidate the acquired organizations into the chosen finance system

- Complete transition synergy tracking

People

- Coordinate with all workstreams to manage the staff turnover stemming from the target state re-organization

- Implement the aligned benefits

- Implement the chosen HRIS

- Launch updated training and career development initiatives for the unified organization

- Implement identified changes in target processes (e.g. recruitment, onboarding, learning and development)

Marketing and Communications

- Launch target branding for the unified organization

- Communicate internally and externally and host events as required

- Prepare a strategy for unified marketing

Technology and IT

- Transition support desk services to the target state, ceasing any for Transfer Services Agreement (if appropriate)

- Migrate to the target infrastructure state, including shutting down unneeded data centers and disposing of excess hardware

- Migrate to target applications while sunsetting the old ones

- Migrate to the target state for end-user computing, including laptops, mobile devices, and networks

Sales and Distribution

- Roll out target Sales and Business Development processes

- Work with Marketing to update collateral and provide training on new and acquired products and services

- Implement aligned incentives and a bonus structure for sales personnel

All workstreams

- Implement target state designs developed in the previous phases

- Sunset unused processes, applications, and standards

- Ensure that team members are training on a new target state

- Shut down workstreams when integration efforts are complete, transitioning to business as usual

Read our 10 tips for post-merger integration success.

READ MOREPost-merger integration checklists by area

The checklists above provide only a guide to the high-level topics that each workstream must consider during each phase of the transition process. They’re purposefully general and non-exhaustive to provide a starting point for the organization’s Integration Management Office (IMO) and workstream leads to build out detailed activity plans for each workstream. The result of planning should be a carefully considered and sequenced activity list of all the major activities required.

Post-merger integration HR checklist: Extract for benefits

The HR workstream may prepare the following list for HR and benefits processes:

- Understand existing benefits, including all relevant information

- Ensure that existing benefits are in place during the transition period, with no benefit interruption

- Design a target benefits state

- Define benefits integration strategy and plan

- Ensure alignment of target benefits with collective bargaining and union agreements

- Re-design, renegotiate, maintain, and adjust medical insurance policies and agreements

- Re-design, renegotiate, maintain, and adjust short and long-term disability and care policies

- Re-design, renegotiate, maintain, and adjust pension programs and agreements

- Re-design, renegotiate, maintain, and adjust life insurance policies and agreements

- Re-design, renegotiate, maintain, and adjust other benefits components

- Develop target benefits communication for new employees

- Communicate target benefits to new employees

- Enroll new employees into benefits

- Develop and adjust training materials

- Conduct benefits training

- Configure and test payroll systems for benefit deductions

Checklists of similar depth should be developed for other HR areas, including Payroll, Organizational Design, HR Policies, Performance Management, Recruitment and Selection, Learning and Development, Talent Management, Employee Directory and Data Management, and HRIS.

Post-merger integration Finance checklist: Extract for cash management

Finance may prepare the following for their cash management processes:

- Review, align, and finalize cash disbursement and reimbursement policies

- Provide instructions on wire transfer forms, contact individuals, and authorities

- Align borrowing and banking processes, including signatures and policies

- Define the process for handling customer payments, wires, and drafts

- Review and confirm the process for petty cash handling and reimbursement

- Align cash management and control processes

- Review and consolidate any other fund transfer processes (e.g. to JVs or international entities)

- Review treasury management function and procedures

- Understand existing financing situation and account structure

- Clarify that cash inflow reporting works properly

- Develop and receive a full schedule of expected invoices for the coming months, with weekly reporting initiated

- Develop a cash-flow forecast

- Establish short-term cash flow and borrowing needs

- Identify all debit arrangements, including tax and vendor pays, and ensure that that these remain correct for the new entity

- Provide all necessary inputs to welcome materials

- Send out new deposit slips, stationery, and stamps

- Ensure that cheques and petty cash are available

- Establish and confirm banking and borrowing arrangements

- Set up all bank accounts (e.g. disbursements, payroll)

- Transition existing bank accounts of an acquired company to the owning company

- Transfer cash from existing to new accounts

- Finalize cash disbursement policy

- Define and confirm interim (and target, if available) process for handling customer payments, wires and drafts

- Define and confirm interim (and target, if available) process for petty cash handling reimbursement

- Define and confirm interim (and target, if available) process for payments (e.g. PoS solution)

- Define and confirm interim (and target if available) process for other key cash management processes

- Define and confirm interim (and target, if available) IT support, including IT systems for cash management

- Develop and adjust training materials on new processes, schedule training

- Deliver training on new cash management processes and guidelines

Organizations should develop checklists of similar depth for other finance functions such as Accounting, Financial Planning and Budgeting, Tax, Insurance, Asset Management, and Financial Technology.

How to start planning a post-merger integration

While the above lists are not exhaustive, they provide an example of the level of detailed planning that workstreams should go into to ensure nothing is missed in the transition process.

Experience can play a big part in saving time and effort when planning a post-merger integration. Building off prior post-merger integration plans and checklists can be a valuable time saver when the organization is already flat out with business-as-usual, and everyone is working on their regular day jobs plus the integration process.

Burnie Group has deep experience in post-merger integrations. We have worked with businesses across a broad range of industries to guide them through the integration of friendly mergers, hostile takeovers and other types of integrations and carve-outs. Our experienced post-merger integration consulting team, proprietary database of over 1,000 integration activities, and library of tools and templates provide businesses with an invaluable head start on the integration process.

Every merger is unique – our experience enables us to partner with your executives and staff to provide the best guidance and expertise to help you plan and execute a seamless integration, no matter the situation. See how our experienced post-merger integration consultants can support your integration.

About the author

Alexey Saltykov

By: Alexey Saltykov, Practice Leader, Post-Merger Integration and Digital Transformation and Chris Penhalluriack, Senior Associate, Strategy & Operations

Read more of our insights on post-merger integrations

Learn more about how Burnie Group can support your post-merger integration.

CONTACT US