As companies grow, technologies evolve, and ownership changes, what has worked in the past will often no longer work. Burnie Group’s value creation practice helps private equity funds and their portfolio companies identify initiatives that will drive value for their business. We develop a clear, practical plan, then leverage our technology and operations expertise to help you execute successfully.

How we can support your organization

Align your leadership: We bring your stakeholders together to align them on your priorities to capture value immediately and through the life of the asset.

Successfully execute your value creation plan: We develop integrated, bottoms-up plans to help you execute your value creation initiatives.

Dramatically increase bottom-line growth: We identify ways to accelerate EBITDA growth in your portfolio companies and pinpoint adjacent opportunities that will drive cash generation and equity value.

Our approach to value creation

Burnie Group’s approach to value creation includes 3 phases. These phases help to identify key initiatives while developing a clear path to execution:

Phase 1: Current state assessment

- Align on strategic priorities

- Identify top opportunities for both revenue and cost

- Uncover potential immediate savings realized through quick wins

Phase 2: Value creation plan

- Define a mutually exclusive, collectively exhaustive (MECE) set of initiatives that fit your business model to deliver on the growth and profitability objectives

- Estimate return and resource plan for each prioritized initiative

- Define a system of KPIs and tracking for each prioritized initiative

Phase 3: Implementation roadmap

- Set up a successful execution of the value creation plan

- Develop an execution roadmap for each prioritized initiative

- Define ownership, accountability, milestones, timelines, and governance structure

- Develop a communication plan for change management

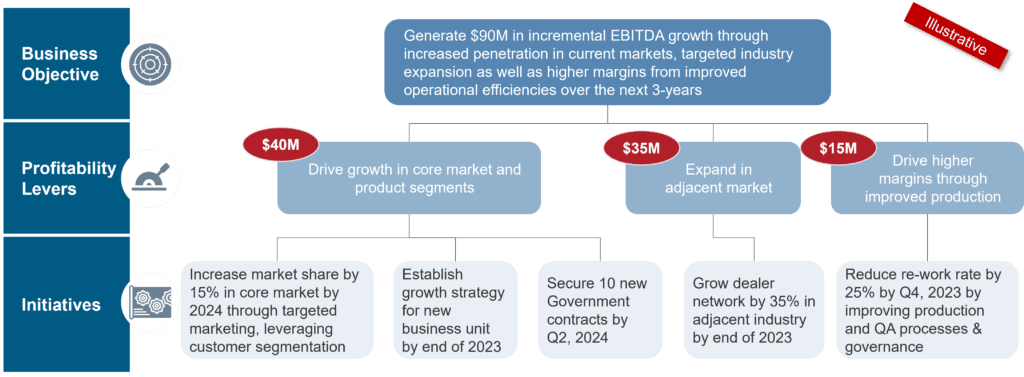

Using our value creation plan framework, we help you define business objectives, identify profitability levers to reach your objective, and plan and align specific initiatives for each profitability lever.

Why choose Burnie Group for value creation

- We tailor our value creation approach to suit your fund and portfolio companies.

- We deliver world-class analytics and synthesis, drilling down to extract actionable insight.

- We turn insights into plans and plans into actions to help you execute successfully.

- We monitor your progress and establish accountability to help you realize the full potential of your value creation plan.

- We have experience supporting clients through all activities related to mergers and acquisitions.

Testimonials

“[Burnie Group] engaged the right stakeholders, fully understood our business, and provided a very thorough step-by-step implementation plan for us to execute.”

“[Burnie Group] did a nice job getting to know our business and industry and honing in on issues and priorities.”

Read why you should build a value creation plan.

READ MOREFind out how our consultants can support your business throughout the entire value creation process.

CONTACT US