Why you need an M&A playbook

M&A transactions, particularly mergers and integrations, can be highly complex, involving numerous moving parts and multiple stakeholders and teams. Organizations that undergo repeated transactions need playbooks to provide a structured approach, reduce risks, and drive value creation. Playbooks make the integration and merger process far more resource-efficient, as everyone knows what to do and when. They ensure smoother transitions, faster integration, and better alignment across teams.

Based on our extensive experience with numerous integrations, mergers, and divestitures, we offer valuable insights into developing M&A playbooks with practical guidance and proven best practices to help you manage these complex transactions effectively.

Key takeaways

-

M&A playbooks bring structure and clarity to complex integrations

-

A good merger/integration playbook is modular and tailored: it should cover overview, detailed planning, and tools/templates

-

Using a playbook helps capture institutional knowledge, avoids reinventing the wheel, and supports repeated M&A activity consistently

M&A playbook types

There are different types of M&A playbooks, each focused on specific stages of the M&A cycle, different areas/functions or deals, such as acquisitions/integrations or divestitures.

Here are some types of M&A playbooks:

M&A Playbooks by deal type

M&A Playbooks by phase

M&A Playbooks by function

- Integration Playbook

- Merger Playbook

- Divestiture Playbook

- Carve-out Playbook

- Due Diligence Playbook

- Pre-Closing Playbook

- Post-Merger Integration Playbook

- HR M&A Integration Playbook

- IT M&A Integration Playbook

- Finance M&A Integration Playbook

- Operations M&A Integration Playbook

One of the most important playbooks is the Merger Playbook/Integration Playbook, which spans both the Pre-Closing and Post-Closing integration phases. This playbook is crucial because mergers impact every function across both organizations and require careful coordination to ensure alignment and synergy realizationrealize alignment and synergy.

Merger playbook structure

While Merger Playbooks/Integration Playbooks may have different structures, we have a structure that resonates best with our clients and has enabled them to navigate numerous mergers and integrations successfully.

When developing a playbook, it is important to understand who the end-users will be. In most cases, these stakeholders include:

- Senior leadership

- Integration management office (IMO) team

- Integration workstreams (including workstream leaders and SMEs)

Most playbooks consist of three main parts:

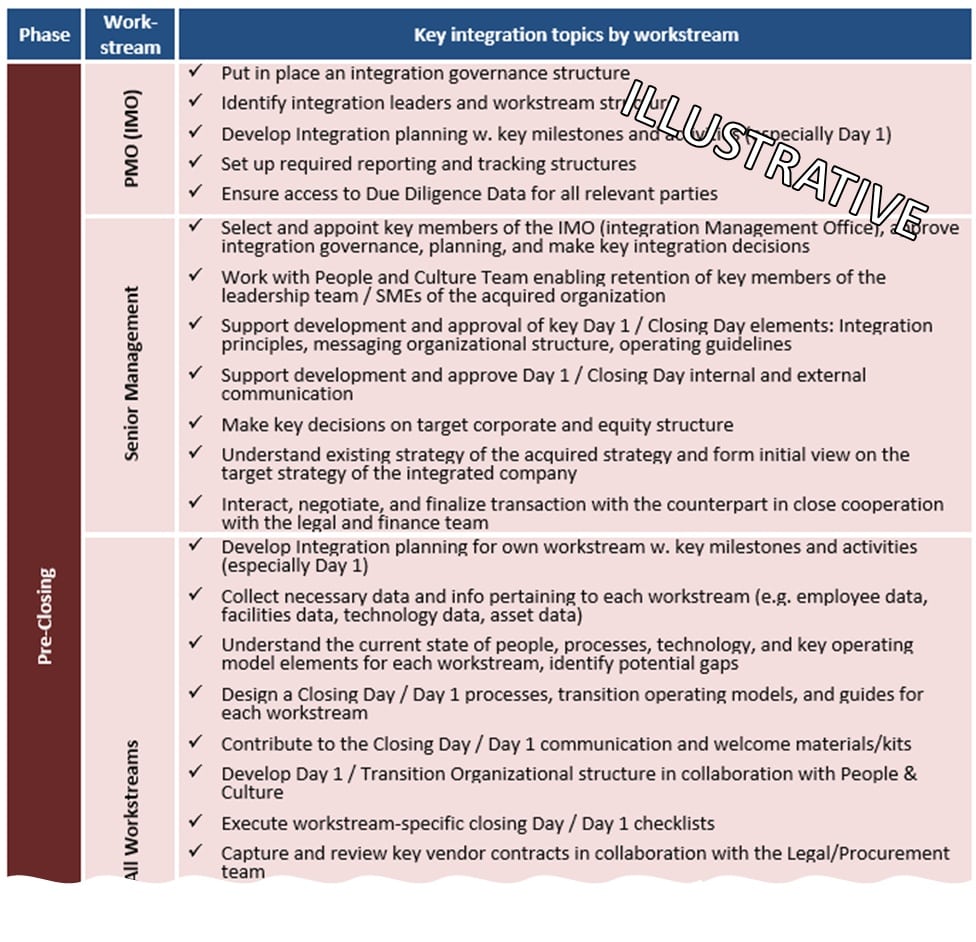

Part 1: Integration overview: Contains general information about types of integrations such as merger, hostile takeover, integration of a carveout, a high-level integration roadmap across all workstreams, integration principles, and key themes such as change management. This enables all stakeholders to understand how the integration evolves and know key interdependencies and milestones.

Part 2: Detailed integration planning: This section provides a detailed breakdown of all milestones and associated activities (mandatory and optional), with timelines, best practices by workstream, and key workstream dependencies. It is structured so that only workstream leaders and SMEs must know their respective parts.

Part 3: Integration artifacts, tools, and templates: Serves as a repository of all artifacts, templates, and tools that can be used throughout the integration. These sections are structured so that only workstream leaders and SMEs must know their respective parts.

The IMO should be very familiar with all parts.

An overview below summarizes the structure of the playbook and identifies who needs to know and use each section.

Merger Playbook

Senior Leadership

Integration Management Office (IMO) Team

Integration Workstream Leaders and (SMEs)

Merger playbook elements

Below, we introduce the parts of an integration/merger playbook. Each playbook is unique, and it is important to tailor it to your organization and its culture.

Part 1: Integration/merger governance

Every integration or merger starts with defining key governance elements, such as roles and responsibilities, integration bodies including the IMO, steering committee, workstreams, their interaction, integration objectives, integration tracking and reporting, integration value creation monitoring, and other governance topics.

Part 1: Integration/merger principles

We have observed that every organization we work with adheres to its own set of integration principles when executing an integration. It is important to document these principles in the post-merger integration playbook and ensure that everyone involved is familiar with them. These principles will serve as the axioms for all future integrations.

Here are a few principles we have encountered in the past—please note that some companies prefer more general principles, while others emphasize specificity:

- Clear and transparent integration across all integration stakeholders

- Minimize disruption to ongoing business and operations

- Ensure that an acquired company’s organization, processes, and technology are fully transitioned to our platform

- Leverage best practices from both our and the acquired organization

We recommend developing at most ten principles and complementing them with tangible examples of each principle’s meaning in the day-to-day integration process.

Part 1: Integration/merger roadmap

An essential element of Part 1 of a playbook is the overall integration roadmap or merger roadmap, which every team member involved in the integration should be familiar with. This roadmap provides a high-level view and timeline of each workstream’s responsibilities during the integration and highlights key differences between various integration types.

The roadmap ensures a cohesive understanding of the integration timeline and clarifies the roles of each workstream. For more detailed information on specific integration milestones or activities for each workstream, team members can refer to the subsequent parts of the playbook.

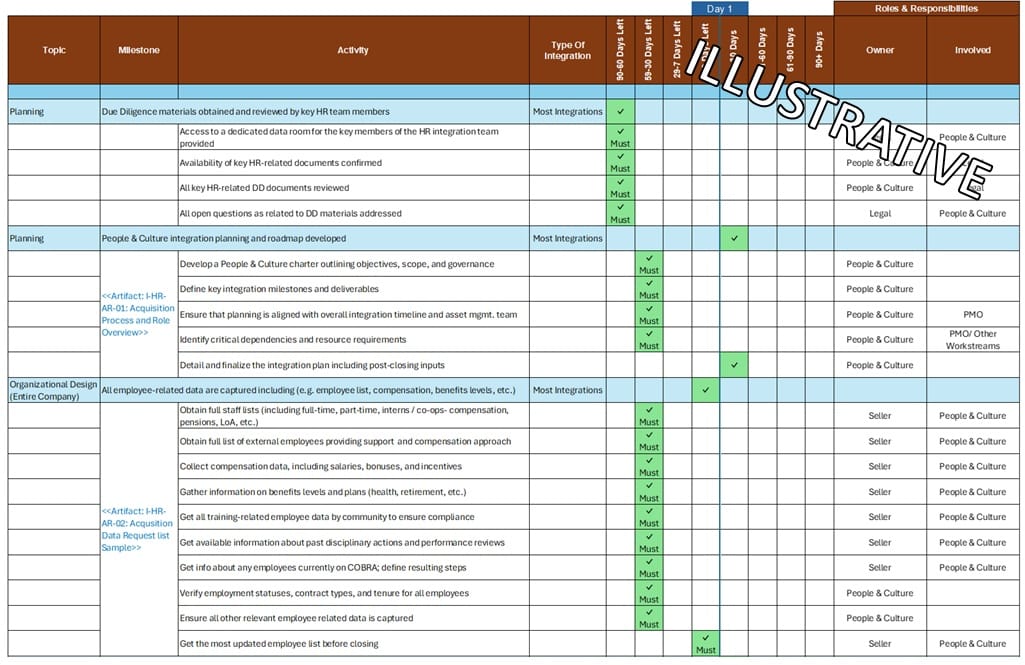

Part 2: Integration/merger plans

Integration plans should include several elements to ensure all parties understand what needs to be done, when, and who is responsible.

It is important to distinguish between milestones and the activities associated with each milestone. Before closing/day 1, integration planning often occurs at the activity level due to tight timelines and the limited scope of work that can be addressed before closing. In contrast, post-day 1/closing day planning is typically at the milestone level.

In most playbooks, we use the format shown below, which can be adjusted to meet the specific needs of the playbook. For example, some clients prefer to differentiate between mandatory and optional activities, enabling them to adapt the integration workload to the deal’s timeline. This flexibility is beneficial when aggressive timelines require only the bare minimum of tasks to be completed.

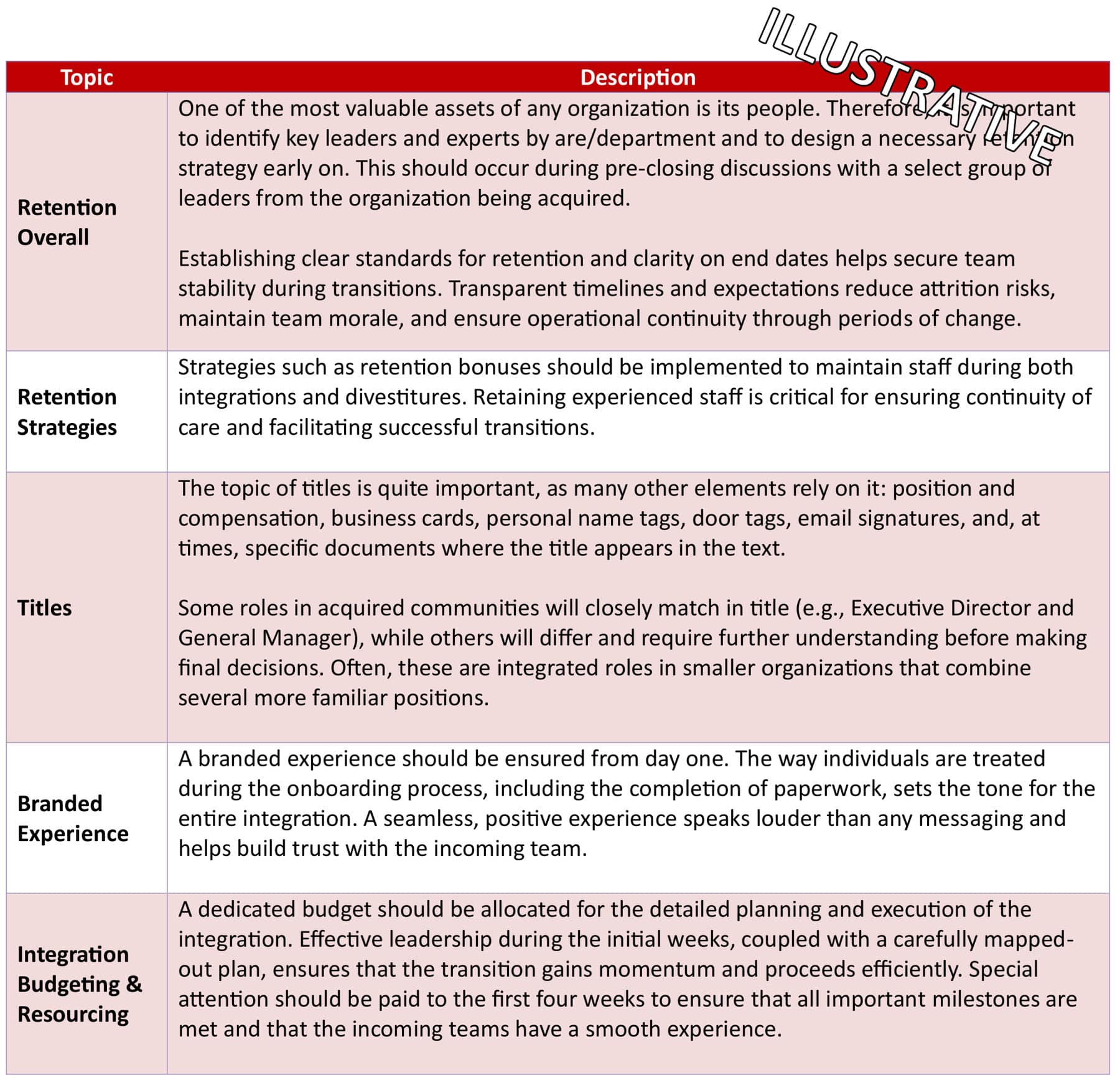

Part 2: Integration/merger best practices

When working with our clients, we often find that integration team members already have experience from previous mergers or integrations. Capturing best practices from past transactions can help avoid known pitfalls.

Ideally, these best practices are complemented by external insights. For example, our proprietary merger, integration, and divestiture best practices database includes hundreds of actionable recommendations that clients can leverage, saving significant time, resources, and effort.

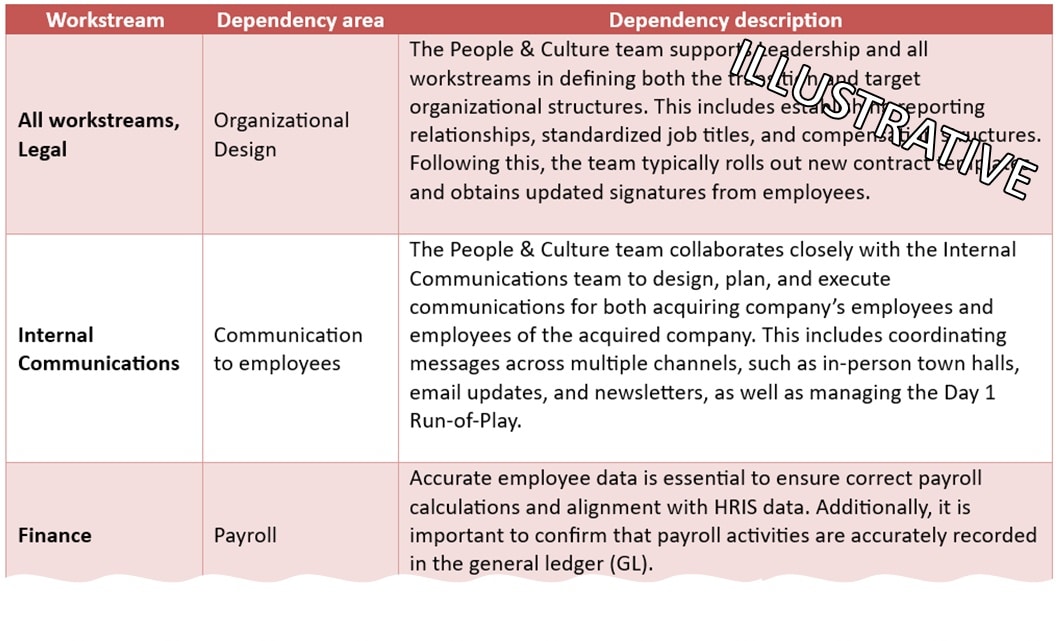

Part 2: Integration/merger dependencies

Our observation has consistently been that integration team members are well-versed in their workstreams, but challenges arise when a theme spans multiple workstreams. Often, critical items are overlooked. For example, each department needs to be involved in a CRM consolidation involving Sales, Marketing, Account Management, and IT. IT themes are often the most complex.

To address this, it is highly advisable to identify and document the key dependencies between workstreams. This list should be further complemented with company-specific dependencies to ensure alignment and prevent oversights.

Explore the topic of IT and technology in mergers and acquisitions in detail.

READ MOREPart 3: Integration/merger artifacts, tools, templates

One of the most important parts of the playbook is this section that captures and organizes all artifacts, tools, and templates from previous integrations. This approach saves significant resources for teams by standardizing tools and eliminating the need to recreate what has already been done.

There are three main categories of elements typically included in this part of the playbook:

Integration artifacts

Artifacts are pieces of content successfully used in past integrations. They vary significantly by workstream and can be either integration-specific or business-as-usual. Examples include:

- Samples of integration communications (CEO’s Day 1 email, employee FAQ)

- List of integration principles specific to the acquiring organization

- Interim integration org charts

- Integration-tailored training materials, such as managing cultural differences

- Integration checklists

Integration tools

Tools are practical resources that support the integration processes and include embedded functionality such as:

- Project management tools

- Integration status reporting and dashboards

- Risk and issue management tools

- Synergy and dis synergy tracking

Integration templates

Templates standardize integration data capture and documentation for consistency and efficiency. Examples include:

• Integration workstream charter templates

• Workstream role assignment templates

• Integration baseline capture templates

• Employee data request lists

Business-as-usual artifacts, tools, and templates

These elements are essential for ensuring operational alignment with the acquired company. Examples include:

- Standard operating procedures (SOPs) by area

- Organizational charts

- Guidelines and rules

- Training materials by area

These resources are typically shared with the acquired company after closing (post-day 1) and outline how the acquiring company operates, ensuring the acquired company or unit aligns with these practices.

Divestiture/carve-out playbooks

If an organization regularly undergoes divestitures or carveouts, such as senior living and healthcare service providers pruning their portfolios of facilities, a Divestiture or Carveout Playbook can be invaluable. Such a playbook clearly defines the different types of divestitures and, similar to an Integration or Merger Playbook, outlines the key milestones and activities involved in the divestiture process.

It should also address divestiture-specific aspects, such as Transfer Service Agreements (TSAs).

Support in developing merger/integration playbooks

Developing a robust merger playbook/integration playbook is a significant undertaking, as it requires a combination of diverse activities:

Consolidating existing merger/integration materials: Gather templates, tools, communication samples, and other relevant resources across the organization.

Conducting interviews with senior leaders: Understand the types of integrations the organization undertakes, details of each type, target operating model design for an integrated company, and insights into best practices and pitfalls from previous transactions.

Facilitating working sessions with leaders and workstream SMEs: Develop a reliable integration sequence for each workstream, detailing milestones, activities, timelines, roles and responsibilities, and supporting artifacts.

Aligning on a standard integration governance model: Establish roles and responsibilities, integration workstreams, tracking and reporting mechanisms, and key regular sessions, including steering committees, workstream check-ins, and working sessions.

Standardizing the approach for tracking integration outcomes: Create templates and processes to identify, monitor, and document synergies, dis-synergies, and costs, including transitional, OpEx, and CapEx.

Ideally, these insights should be complemented by external best practices and reviewed for completeness by an experienced partner who has managed similar projects multiple times. Such expertise ensures the identification of any missing milestones and activities.

For instance, our M&A team at Burnie Group manages and continuously updates proprietary databases of M&A insights, including:

- Post-merger integration database: Featuring thousands of milestones and activities for various integrations.

- Divestiture/carve-out database: Covering thousands of milestones and activities tailored to different types of divestitures.

- Communication artifacts database: Offering examples of key transaction communications, such as CEO day 1 emails, employee FAQs, and external press releases.

- Integration synergy and benefits database: Detailing numerous synergy levers that can be pulled during integrations to create value.

Developing and battle-testing a robust integration playbook during an ongoing integration or merger requires a substantial resource commitment. For this reason, seeking external support and a trusted partner is often a prudent decision.

If you are considering developing an M&A playbook or planning an integration or divestiture, our M&A leaders are available to discuss your needs during a discovery session.

Frequently asked questions

What is an M&A playbook?

It’s a structured guide or roadmap that outlines how to carry out a merger, acquisition, integration, divestiture, or carve-out — covering all relevant phases (pre-closing, post-closing), functions (HR, IT, finance, operations) and workstreams. It helps coordinate efforts across the organization.

Why not treat an integration like any other project?

M&A integrations are more complex than standard projects: they often involve multiple functions, organizational change, cultural issues, systems consolidation, and shared dependencies. A playbook ensures these interdependencies are recognized and managed, reducing the chance that critical tasks fall through the cracks.

Who should use the playbook within an organization?

Key users include senior leadership, the IMO team, and workstream leaders/SMEs. The playbook is structured so that different parts are relevant to different roles: a high-level overview for executives, detailed plans for workstream leads, and templates/tools for SMEs

About the author

Alexey Saltykov

Our insights on M&A

Leading a Seamless Post-Merger Integration in Financial Services

Find out how we can support your mergers, acquisitions, and divestitures.

CONTACTS US