Key takeaways

- A one-size-fits-all telematics strategy rarely works: insurers must adapt to region-specific factors

- Consumer adoption is a major hurdle and addressing privacy, awareness, and trust is critical

- Telematics has potential beyond pricing: new use cases can improve safety, claims handling, and predictive risk management

Why telematics is crucial to the modern insurance carrier

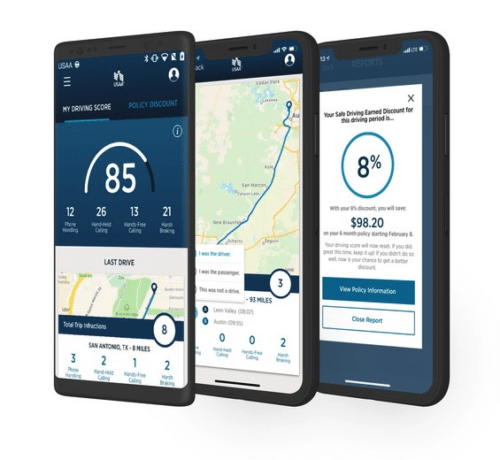

Telematics is a highly efficient means of collecting vast amounts of driving data through onboard computer systems or mobile applications utilizing sensors, GPS, accelerometers, and cellular or satellite communications. The collected data feeds into artificial intelligence (AI) software and machine learning algorithms to identify patterns and make actuarial predictions about driving behaviour and habits. Drivers use this information to understand their tendencies better and identify improvement areas. In addition, insurers use this technology to develop UBI, enabling insurers to price individual policies based on drivers’ driving behavior. Overall, telematics improves risk assessment accuracy and provides tailored, cost-effective insurance policies to its customers.

How insurers can capture growth and maximize potential in the telematics market

With macro predictions for telematics in mind, insurers must plan for the future to ensure they capture their share of the growth in the telematics market. They must also plan to utilize this technology to maximize its potential. Three elements will maximize telematics capabilities over the next one to three years:

- Operationalizing a well-defined strategy across geographical markets

- Increasing telematics adoption

- Developing new telematic use cases as the technology evolves

1. Operationalizing the telematics strategy

Telematics strategies and operating models should reflect the uniqueness of each region where an insurer plans to deploy telematics capability. Regions within Canada and the United States have unique demographics, consumer appetites, regulations, and technological capabilities. A one-size-fits-all approach will not work when deploying, managing, and growing a telematic product offering in each region. There are three key variables to consider when deploying a telematics strategy and designing an operating model across borders: privacy laws, consumer preferences, and technological infrastructure.

Privacy laws are unique in each geographical location, which impacts what an insurer can and cannot do regarding privacy. While there are often similarities in how provinces and states create these laws and regulations, insurers using telematics across geographical borders, including within and between the United States and Canada, should be aware of the differences between jurisdictions and adjust their operating model to reflect these nuances. Privacy laws differ between regions in four key areas:

- Notice and consent requirements: requirements for providing notice to consumers and obtaining their consent to collect and use telematics data

- Data retention and deletion: requirements for retaining telematics data and deleting it upon request by the consumer

- Data sharing: restrictions on the sharing of telematics data with third parties

- Compliance obligations: obligations for ensuring compliance with telematics privacy laws, such as record-keeping, reporting, and audits

For example, California and Illinois have similar political ideologies but drastically different privacy laws. California has the most stringent privacy laws outlined within the California Consumer Privacy Act (CCPA), including opt-in or opt-out requirements for selling telematics data. By contrast, Illinois has more moderate regulations outlined within the Biometric Information Privacy Act (BIPA). BIPA is more relaxed than the CCPA because BIPA focuses solely on biometric data, whereas the CCPA is a broader privacy law that covers a wide range of personal information.

In Canada, the use of telematics devices by Alberta employers is generally unrestricted. Employers can install telematics devices in company vehicles and use the data collected to monitor employee performance, track vehicle usage, and improve safety. In Ontario, telematics laws are more restrictive, with privacy laws that limit the use of telematics devices in vehicles. Employers must obtain employees’ consent before installing telematics devices. In addition, employers must ensure that the data collected is used for legitimate business purposes only. In 2022, the government of Canada introduced the Digital Charter Implementation Act to strengthen privacy laws for the use and development of AI. This act has a pervasive impact on how insurers deploy telematics nationwide.

Telematic preferences can vary significantly between geographical regions based on the population’s demographics, the level of technological adoption, and the insurance market in each area. There is a growing trend in consumers craving personalized UBI telematics, expedited due to the Covid-19 pandemic putting a halt to consistent, long commutes that traditional insurance policies were ill-equipped to handle. While the focus for UBI has been on giving consumers a break for their decreased driving, the industry should invest in educating customers who drive a lot and have good driving habits. Their better driving habits could then translate into lower insurance premiums.

Here are a few case studies to consider. In New York, consumers may be less likely to embrace telematics programs due to lower vehicle ownership and an increased reliance on public transit compared to national averages. 56.5% of New Yorker City workers use public transit compared to Los Angeles’s 10.6%. In addition, only 71% of New Yorkers own a vehicle, making it the second lowest state in the country. Texas may be more likely to adopt telematics due to the state’s reliance on personal automobiles as the primary source of transportation and longer distances travelled. Texas has the second-highest average miles per commute at 45.4 compared to North Dakota’s 38.4. In addition, consumers in Florida may have more resistance to telematics due to the state’s large retiree population who drive less frequently and are more reluctant to adopt new technologies. 21.3% of Florida residents are over 65, compared to Utah’s 11.7%. The average Florida resident over 65 drives 7,600 miles per year, about 50% of the national average of 14,500 miles.

Consumer preferences are also likely to differ based on factors beyond geography. When analyzing telematics adoption statistics, consider evaluating whether the statistics represent the demographics accurately and proportionately to ensure the risk profile adjustments reflect the characteristics of the driving population. According to the Bureau of Transportation, the average American man drives 67 minutes daily compared to the average woman, who drives 21 minutes. A driver who regularly drives long distances and spends a lot of time on the road is likely to generate more data, providing a more accurate view of driving behavior and risk profile. Therefore, it makes sense for men to adopt telematics at a higher rate, given their increased reliance on automobile travel and higher lifetime insurance premiums compared to women.

Technology infrastructure

Telematics technology capability can differ region-to-region based on investment in technology infrastructure, regulations, industry developments, and customer demand. For example, some regions have better network coverage and data storage capabilities, while others are more advanced in data processing and security measures. Additionally, technology infrastructure continues to evolve. Regions that are infrastructure deficient today may invest heavily over the next several years and signal an opportunity to enter the market. The United States will likely invest in infrastructure due to the bipartisan Infrastructure Investment and Jobs Act to increase high-speed cellular access to rural Americans. Increasing cellular access could expand the potential for nationwide real-time telematic insights and analysis.

When developing a telematics strategy, it’s important to consider the following three telematics technology infrastructure implications:

- Network coverage: availability, reliability, and breadth of coverage across each geography

- Connectivity: the ability to support high-speed data connectivity and communication between vehicles and the telematics platform

- Data storage and processing: the amount of data generated region-to-region and the infrastructure required for storing and processing this data in real-time

Read about the future of P&C insurance in Canada.

READ MORE2. Adoption

Privacy and data sensitivity

This consumer is hyper-sensitive to how companies handle personal data, particularly how that information is used, where it is stored, and with whom it is shared. An estimated 92% of Canadians are concerned about the privacy of their personal data. The biggest hesitation consumers face in adopting telematics is privacy concerns. Today’s telematics inherently requires access to a consumer’s personal property – either a mobile device or vehicle hardware – to track and collect data on driving behavior.

Insurance companies must embrace transparency, user control, and airtight data security to address privacy concerns. Insurers can start by providing clear and concise communication on what data is collected, why, and how it is used. From there, insurers must ensure that the data collected is secure and protected by implementing robust data security measures such as encryption, firewalls, and regular data backups. The final step is offering customers control over their data by allowing them to opt in or out of data collection and self-manage their data through secure access and deletion options. Ultimately, companies must be transparent about how their data will be used and stored and reassure consumers that they will manage their data with good intent.

Awareness and understanding

As with any technological innovation, many consumers need more understanding and awareness of telematics and its benefits. As mentioned, 80% of consumers are not using telematics in Canada today. Insurers have several options to improve awareness and drive adoption. First, they must be clear about their target demographic segment and where that consumer interacts.

Gen Z and Millennials are the most attractive demographic for telematics adoption, who are tech-savvy and cost-conscious. Insurers could market telematics to Gen Z and Millennials by exploring alternative channels, including digital apps, social media, and influencer marketing. To market beyond this demographic, insurers could train resources older consumers trust and depend on, including brokers and agents, who can drive awareness through direct outreach and answer personal questions about the technology.

While traditional marketing efforts have had some success to date, insurers need to move into more direct and creative solutions to increase awareness. Beginner drivers, especially adolescents, would benefit greatly from telematics to learn good driving habits. To capitalize on this target market, insurers could educate parents on how telematics encourages safer driving for their teenagers.

With the growing trend of buying insurance directly, apps and online marketing material must outline clear, compelling benefits for the consumer with minimal fine print.

Resistance

Lastly, some consumers are reluctant to embrace this technology. Telematics can track and report on driving habits that some may not want insurers to monitor. For example, someone who frequently speeds or engages in reckless driving likely doesn’t want to have that information recorded. According to a study by Transport Canada, 81% of drivers speed, with 30% speeding well above the median average. Additionally, consumers might view telematics as more beneficial for the insurer than the consumer.

For insurance companies to overcome consumer reluctance, they must develop compelling reasons for a consumer to adopt telematics beyond a reduction in future premiums. One way is through upfront incentives. For example, offering instant cash-back deposits on insurance premiums to put money into the consumer’s pocket today is a powerful incentive. Another is collaborating with vehicle manufacturers to embed telematics devices in new vehicles.

3. Usage

Embedded telematics to service theft and injury

The future of telematics will be original equipment manufacturer (OEM) telematics. OEM telematics will be produced by the automaker and embedded directly into their cars, as opposed to mobile telematics applications, which are the predominant form in Canada today. Toyota, BMW, Ford, Tesla, and GM are investing heavily in equipping their vehicle with the necessary technology to enable onboard telematics. In 2021, approximately 50% of new cars in the United States were equipped with telematics systems.

Embedded telematics will generate several new use cases. Auto theft is a rising trend across North America, particularly in the heavily populated regions around Toronto, which have seen a jump in theft by as much as 45% a year. Embedded telematics can aid vehicle recovery by tapping into the vehicle’s GPS technology. The police can use GPS information to track down stolen vehicles. This will benefit insurance companies because it can reduce the claim cost of vehicle replacement.

Immediately following a car accident, an AI-equipped onboard telematics device can automatically generate an emergency vehicle response request with details on the accident severity, collision speed and type, and expected injuries. An emergency vehicle response request enables quick, prepared, and informed intervention, which can reduce severe injury. Ultimately, this will reduce the personal toll of accidents and cut down on future claim costs.

Regulators will likely be nervous about the widespread embedding of trackers into personal vehicles. However, the correlation between the presence of telematics devices and increased road safety that significantly cuts down on bodily harm is a clear, compelling argument in favor of embedded telematics. In Ontario alone, car accidents result in approximately 24,000 personal injuries and 500 deaths annually.

Claims processing

Telematics can improve claim settlement and fraud detection through real-time data analysis. Telematics can verify accident details, flag conflicting information, and speed up the claims process. Machine learning can comb through large amounts of data to confirm details of an accident, such as the time, location, speed and severity of the incident. This can help resolve disputes, streamline the claims settlement, and flag potential fraud when data conflicts with claim reports.

Artificial intelligence, combined with OEM data, can assess the severity of an accident in real time. Then AI can apply the damage assessment against current market repair rates for parts and labour and produce an estimated total repair cost to either settle the claim on the spot or write off the vehicle. In its most sophisticated form, real-time accident assessment with on-the-spot claim settlements can potentially reduce the risk that claims matters are escalated to expensive mediation or litigation, cutting down on the roughly 52% of drivers who hire attorneys following a bodily injury.

Predictive analytics

Introducing OEM telematics capabilities in new cars will expand predictive analytic capabilities. AI can detect anomalies in data and use predictive modelling to inform drivers about accident likelihood, vehicle wear and tear, and specific maintenance requirements. The result is greater specificity, timeliness, and accuracy than malfunction indicator lights (MIL) systems to predicate problems before they occur.

For example, an unusual pattern in fuel consumption or a sudden decrease in engine performance can alert the driver to pull over immediately, triggering preventive maintenance before engine failure causes an accident. In anticipation of inclement weather, OEM telematics can also identify and perform a tire traction assessment using brake reaction data (force, temperature, pressure, reactiveness, and driver habits). The tire traction assessment can warn drivers to change their tires before they can cause an accident.

By using predictive modelling, AI can monitor the health of vehicles in real-time and identify preventable incidents before becoming catastrophic. Additionally, telematics systems can monitor driver behavior to detect distracted driving. Camera monitoring can detect phone use, track eye and head movement, and identify abnormal driving patterns, such as lane drifting. Telematics can also detect sudden unprepared breaking. By identifying distracted driving, telematics can alert the driver to focus on the road to prevent an accident and associated claim or as informational evidence for the insurer in their cause of accident review. Finally, AI algorithms can analyze telematics data from individual vehicles to benefit the consumer by creating personalized maintenance plans based on usage patterns and vehicle performance instead of arbitrary mileage counts.

How insurers can prepare for adopting telematics

As telematics capabilities expand and users become more interested in adopting telematics, insurers must create a clear strategic plan and tactical roadmap to ensure they can capture their share of this new market. Developing a strategic plan will also enable insurers to utilize this new technology to create the most value for their organizations. In addition, insurers with a well-defined plan for the next three to five years will be in the best position to defend and grow their market share against less calculated and organized competitors in this space.

Burnie Group has extensive experience helping insurers create and execute strategic plans and tactical roadmaps. Contact us to learn more about how we can support insurers.

Frequently asked questions

Why can’t insurers just use the same telematics policy structure everywhere?

Because regulatory, demographic, technological and cultural conditions differ significantly by region. Privacy laws vary; what’s permissible in one province or state might be restricted in another. Consumer readiness and preferences (e.g. comfort with data sharing, attitudes to black-box devices) also change by geography. Therefore, insurers must adapt their operating model for each market rather than apply a uniform approach.

What prevents customers from signing up for telematics-based insurance today?

Several factors can deter customers: concerns about privacy and how their driving data is used, lack of awareness or understanding of telematics benefits, discomfort with constant monitoring, and skepticism that benefits will favor the insurer more than the consumer. Overcoming these barriers requires transparency, clear communication, optional opt-in, and consumer incentives.

Beyond lower premiums, what benefits can telematics bring to insurers and drivers?

Telematics can support new services and efficiencies: real-time theft recovery (via embedded GPS), automatic accident detection and faster emergency response, streamlined fraud detection and faster claims settlement, and predictive analytics for vehicle maintenance or risky driving behaviors. For drivers, this can mean safer driving, potentially fewer accidents, and more personalized services.

By: Alexey Saltykov

Read more of our insights on insurance

Find out how we can support insurance companies.

CONTACT US