Since the start of 2022, Canadian home buyers and owners have been hit with a shock with prime interest rates rising over 4%. House affordability has been an issue in major Canadian cities for many years. Now, however, consumers must also worry about high interest payments and the increased uncertainty these drastic rate changes have brought about in the market.

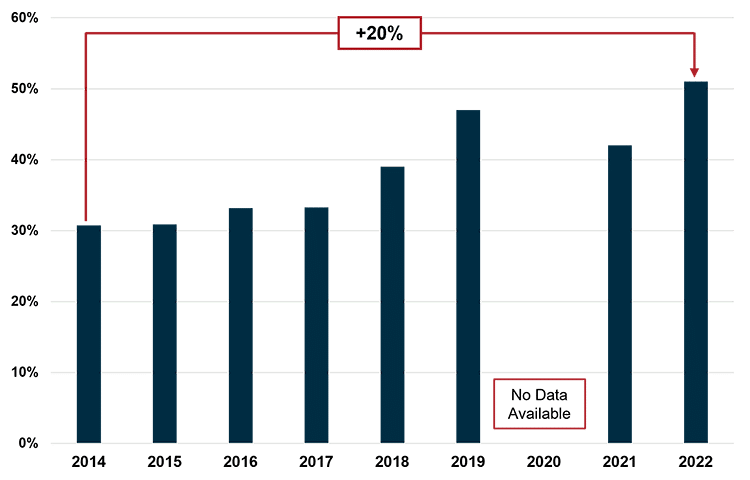

Mortgage brokers have long been a trusted resource for Canadian borrowers navigating these high-stake financial waters. Working with a broker can benefit potential borrowers in many ways. For most, the first thought that comes to mind when considering working with a broker is their ability to find the best possible rate, but other benefits of working with brokers have become more relevant in recent years. For example, brokers give consumers a flexible range of alternative loan options from diverse lenders. Alternative loan options are especially valuable for Canadians who do not qualify for a traditional mortgage, who are becoming an increasingly large portion of the population1. Given this, it’s unsurprising that brokers’ market share, as reported by CMHC, increased to 51% in 2022, a steady climb since 2014, when brokers had just under a third of the market2.

Given that the nature of a broker is to shop around for rates, competition amongst lenders within the broker channel is fierce. For example, a broker survey from 2022 reported that 82% of brokers submitted applications to at least five lenders in the previous twelve months3.

Mortgage broker market share in Canada1

With brokers‘ market share rising and competition among lenders intensifying, it has become increasingly important for lenders to have a winning strategy for attracting mortgage brokers. Burnie Group recently spoke with mortgage brokers to understand what influences their decision to deal with certain lenders and not others. Based on these conversations and our research, we have identified a number of these strategies.

3 Strategies for lenders to win more mortgage broker business

1. Streamline the mortgage application process with quality underwriter coverage

We heard a clear and consistent message when we spoke to brokers: they want quick turnaround times when they submit a mortgage application to a lender. Quick turnaround times are a priority because the end customer may compete with other bidders or have a tight window to close on financing before their offer expires. In addition, brokers want to serve their customers as quickly as possible to avoid the risk of their customers taking their business elsewhere.

While lenders can make small improvements through process optimization initiatives, the most impactful way to reduce turnaround times, according to brokers with whom we spoke, is to streamline the process by assigning a dedicated underwriter to the broker. Ideally, this underwriter can complete the adjudication and the full range of tasks needed to approve an application, including compliance checks. Working with an underwriter who can complete all tasks associated with an application eliminates the need to hand off the application to other groups and avoids increased delays.

The impact of working with a dedicated underwriter is significant. For example, one broker said they can push through applications within a day when dealing with a dedicated underwriter, compared to delays of a week or more when the application is in a general queue.

Working with an assigned underwriter also offers the opportunity for the lender and the broker to establish a closer relationship. One broker shared, “It is easy to work with the same lender when you already know their products and have a relationship.”

Of course, lenders don’t have the resources to offer this degree of service to all brokers that come through the door. Given limited resources, lenders must consider the incentive structures they build and the brokers they attract.

2. Incentivize top performers

Like many other industries, mortgage broker sales are concentrated at the top. An estimated 90% of sales are completed through only 10% of brokers4. Consequently, it is in lenders’ best interest to create an incentive structure that attracts these top performers.

Before lenders can provide incentives to top performers, they must determine how to define a top performer. Lenders can generally measure performance by two main metrics: total volume funded and funding ratio. The total volume funded is a good measurement of the total business a broker brings in. However, lenders should also consider the funded ratio to determine a broker’s efficiency and the quality of applications they submit. The funded ratio can be calculated as:

(Mortgage applications submitted to a lender / Mortgage applications closed with that lender)4

Brokers who achieve a certain threshold on both these metrics should qualify for enhanced benefits from the lender. In addition to incentivizing top performers, lenders can identify and recognize up-and-coming brokers to foster strong relationships for the future.

We already covered one significant benefit a lender can use to incentivize brokers: assigning a dedicated underwriter. Another lever is creating tiers of performance-based compensation. While brokers shared with us that base commissions do not differ from lender to lender enough to sway their decision on who to do business with, some lenders offer more upside once the broker achieves a certain level of performance. For example, some alternative lenders increase the portion of the lender fee they pay out to brokers if that broker performs at a certain level.

With the increase in consolidation of brokers working at large brokerage houses, some lenders decide to make their agreements at the brokerage level as opposed to the individual broker level. While both options have their merits, lenders should consider the trade-off between being able to attract large volumes through brokerage-level agreements versus incentivizing strong individual performance with broker-level agreements.

3. Establish clear market positioning

While creating incentives to attract the business of strong brokers is a key area for lenders to consider, lenders must also keep consumer needs top of mind. Ultimately, they are lending money to the end consumer.

There are various circumstances a consumer can find themselves in when looking to get approved for a mortgage. For example, they could be a newcomer to Canada buying their first home with little credit history, or they may be a tenured investor acquiring an income property. Based on these circumstances and borrower profiles, a mortgage broker must select the lender that best meets their customer’s needs. A broker’s ability to do this often distinguishes them from other brokers. For example, one broker we spoke to shared a case where he achieved a lower down payment requirement for a customer thanks to a unique program a lender offered.

To assist brokers in their effort to find the best loan for their customers, it is up to the lender to ensure that they position themselves to brokers in a way that makes it clear what they can offer borrowers and what differentiates them from other lenders. With full-service traditional banks, brokers expect a breadth of offerings, but there is still an opportunity to differentiate on the margins with policies like prepayment flexibility. These lenders should ensure brokers are aware of these subtle differences in their offerings. Monoline lenders have an opportunity to be truly differentiated by being known for a particular offering that services a niche customer segment.

Lenders at large can ensure brokers have the necessary knowledge level through several channels. As mentioned earlier, a dedicated underwriter can act as a strong connection between the lender and the broker. As part of this relationship, the underwriter can keep the broker up to speed on the latest features and changes to the lender’s product offering. Alternatively, if the lender places a stronger focus on the brokerage house instead of the individuals, they can execute formal training programs across the firm to ensure knowledge of their offerings. These training programs can help to develop future “top performers” for lenders.

Prioritizing share-gaining opportunities

While we have identified the levers above as crucial drivers for attracting brokers, there are other measures adjacent to these options that broker-based lenders can take to increase their market share, such as:

- Offering preferred rates to brokers

- Improving application transparency through technology

- Expanding the suite of product offerings

With so many options, it can be difficult to choose where to start. We find that having a quantitative framework with clear criteria can help determine which ideas are more likely to be successful for a lender.

Our evaluation framework for market share-increasing levers

- Evaluate each lever based on its forecasted market share impact. Be sure to consider the realities of your firm today such as your existing underwriter coverage and current interest rates offered.

- Evaluate the time to execute each initiative, while considering the resource constraints of your firm.

- Plot the two data points for each lever and create a prioritized roadmap based on the most attractive options.

The need for lenders to compete

The mortgage broker channel’s market share has steadily increased over the past decade. Signs point to this trend continuing in the coming years. Although not all major Canadian banks participate in the channel today, there is a history of big players coming in and out of this market. In addition, a strong secondary tier of alternative lenders constantly vying for market share suggests competition will intensify further.

Fortunately, lenders can leverage tools and strategies that empower them to win in this market. Lenders should evaluate their options while considering the strengths and constraints of their firm in determining the most advantageous broker strategy.

Sources

- 1Number of private mortgages growing as Canadians struggle to secure traditional loans, FSRA warns

- 2CMHC Mortgage Consumer Survey Results 2014 to 2022

- 3Brokers on Lenders 2022

- 4What “Funding Ratios” Mean to You

About the authors

Graeme Hartlen

By: Jesse Castiel, Engagement Manager, Graeme Hartlen, Practice Leader & Andrew Wolch, Practice Leader

Read more of our insights on insurance

Find out how we can support insurers with our consulting services.

CONTACT US