Experience a pragmatic mergers and acquisitions (M&A) approach that works

What to search for in an M&A consulting firm

Typically, mergers, acquisitions, and divestitures happen on an aggressive timeline to ensure the success of changes like the following:

- Very limited time to close the deal

- Not enough time to prepare properly for Day 1

- Need to minimize integration time to deliver quickly on planned benefits

Having guided and supported numerous mergers and acquisitions (M&A) and post-merger integration (PMI) activities, Burnie Group believes that there are three things you must search for in your M&A and PMI consultants.

- Pragmatic and able to do the heavy lifting instead of being theoretic

- Value for work – at the end, you must see M&A benefits and not gigantic invoices

- Be knowledgeable in your industry – the secret of successful mergers and acquisitions often hides in details

Costs of M&A consulting

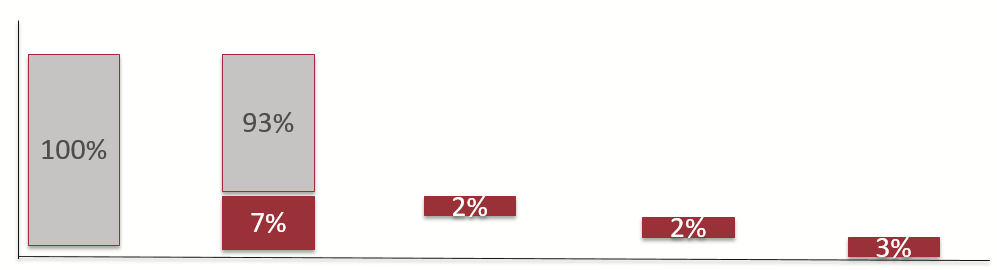

Most consulting firms know that there is a lot of money to be made in this space since the cost of mergers and acquisitions consulting services does not often appear high when compared to overall deal size. The majority of M&A plans predetermine a share of the integration budget (usually a few %) to spend on external M&A consulting services. The charts below outline standard industry monetary compensation.

M&A Consulting fees often reach 2-3% of the total deal size adding up in some cases to millions of dollars. At Burnie Group, we believe it should not be like that. We offer M&A consulting services at a fraction of the price other consultancies charge. Interested in learning more? Contact us for a no-obligation discussion. Below is an overview of different M&A consulting options available on the market, with all pros and cons.

Comparison of mergers and acquisitions consulting services

● Quick and intensive

● Quick and intensive

● Right level of depth

● Moderate pricing

● Can be somewhat theoretical

● Sometimes, not actionable enough

● Can be overly long

● Sometimes, not actionable enough

● Very extensive integration budget available

● Very extensive integration budget available

● Integration budget must be handled responsively

How our post-merger integration services can help you

A significant part of mergers and acquisitions fails to deliver on expected benefits. Integration of any merger or acquisition should be planned and executed with accuracy and precision in order to deliver expected benefits. The heavy-lifting comes after the deal closes.

Our PMI experts have extensive experience in setting up integration governance, putting in place structures required for successful integration and working hand-in-hand with your teams to define all elements of the target state in detail and executing this plan. Simultaneously we will make sure that you deliver on estimated benefits and extract value of your M&A deal.

We are a phone call or email away – contact us for an initial discussion and assessment.

Find out more about our mergers and acquisitions consulting services.

CONTACT US