Integration management

Managing an integration is one of a company’s most complex undertakings. Integrations vary in form and scope—ranging from full-scale and carve-out integrations to partial mergers. Regardless of the type, an integration is typically a multi-month endeavor that demands significant coordination and resource allocation to ensure success.

For anyone considering an integration, we have gathered all the roles and responsibilities of building an integration management office. Integration management usually encompasses several key areas:

- Integration governance

- Integration strategy

- Integration planning

- Integration project management

- Integration risk and issue management

- Integration performance management

- Integration communication

- Hands-on integration work

- Integration change management

- Synergy and benefits tracking and extraction

- Integration data and document management

Key takeaways

-

The Integration management office (IMO) is the central hub that drives all aspects of an integration

-

IMO covers a wide range of responsibilities beyond just project management

-

Using an IMO, ideally with experienced and dedicated resources, is often critical to realizing the expected value of a merger or acquisition

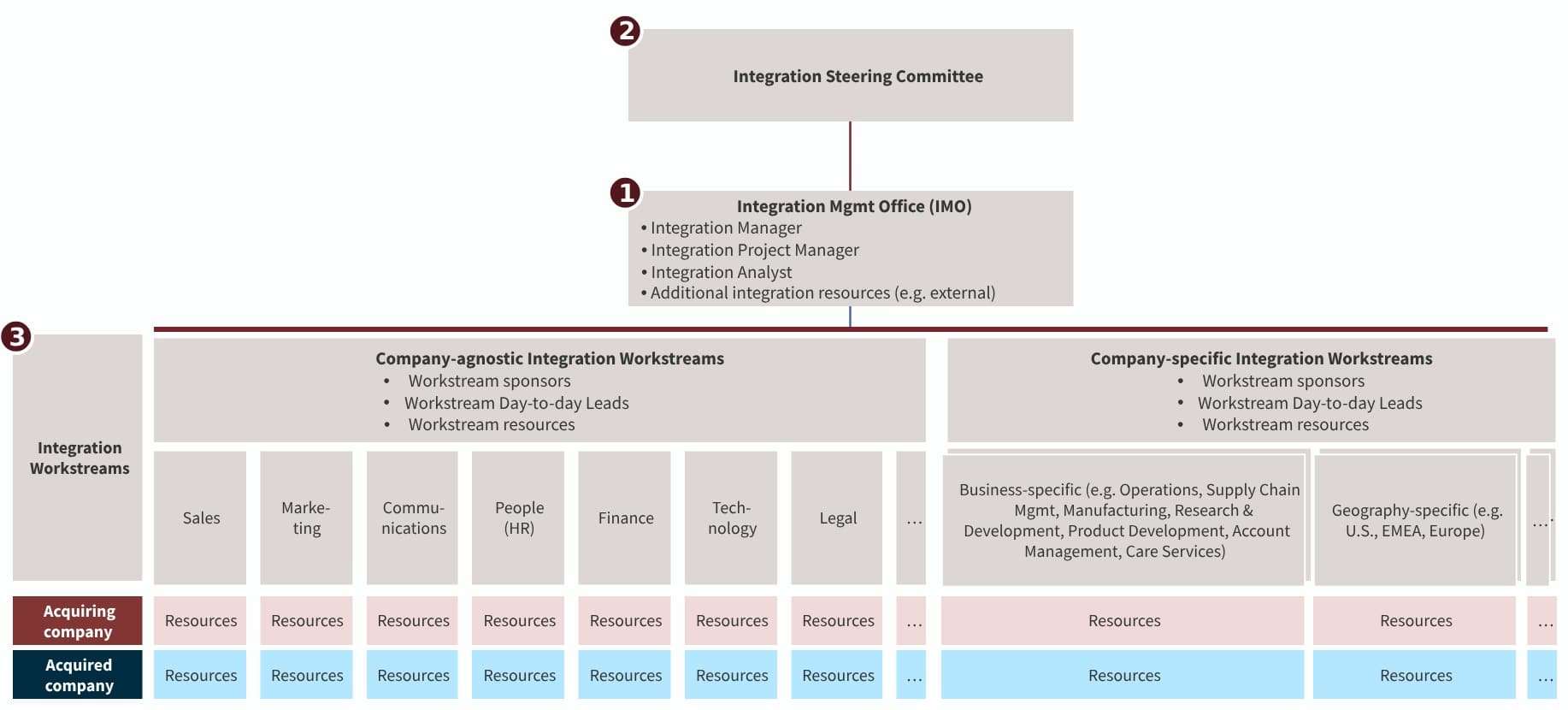

Integration management office structure

The integration management office (IMO), sometimes called the post-merger office (PMO), is a temporary organizational structure established to oversee the process until the acquired organization is fully integrated into the acquiring company per the integration plan.

Think of it as a specialized task force empowered with extended responsibilities, dedicated resources, and access to key organizational stakeholders to drive the integration forward.

The IMO is only one part of the organizational construct required to deliver an integration successfully. The integration steering committee and workstreams are other indispensable components of integration Management.

Integration management office roles and responsibilities

- Integration governance: Typically, the integration management office lead, the integration manager, is appointed by senior leadership based on skills and capabilities, such as seniority, experience, and organizational knowledge. Once appointed, the integration manager assembles a team necessary to drive the integration process successfully. This includes defining the associated integration governance structure, such as roles and responsibilities, and managing interactions between the acquiring and acquired organizations.

- Integration planning: Every integration, whether full, partial, or back-end, should align with the enterprise’s overall strategy. The IMO works closely with company leadership and workstream leads to develop a comprehensive integration plan that aligns with the integration strategy and organizational goals.

- Integration project management: Integrations are intricate processes requiring precise coordination of multiple stakeholders, workstreams, and moving parts. The Integration Management Office (IMO) is the central hub, organizing key meetings like steering committees, workstream check-ins, and problem-solving sessions. Collaborating with workstream leaders, subject matter experts (SMEs), and executive assistants (EAs), the IMO ensures seamless execution. With strong project management at its core, the IMO defines milestones, activities, timelines, and responsibilities while tracking progress to keep the integration on schedule and aligned with goals.

- Integration risk and issue management: Integrations often carry diverse risks, such as customer attrition, stakeholder concerns, employee retention, process disruptions, or technology failures. The IMO proactively identifies and mitigates these risks and coordinates resolution efforts to keep the integration on track.

- Integration performance management: Besides tracking progress through completed milestones, the IMO oversees the measurement of broader metrics such as employee and customer attrition, both positive and negative, cross-sell performance, integration costs, changes in brand perception, and company reputation. The IMO regularly collects and compiles this data and presents findings to senior leadership at defined intervals.

- Support for integration change management: The IMO collaborates with various workstreams to plan and execute effective change management initiatives, prioritizing clear communication and stakeholder engagement. This includes developing strategies to keep internal and external stakeholders informed, facilitating feedback opportunities to address concerns, and ensuring alignment throughout the process. The IMO also supports discovery and training sessions to help teams adapt to changes, organizes integration events to engage stakeholders, and creates practical resources like guidelines and playbooks to guide transitions.

- Support for integration synergy and benefits tracking and extraction: Most integrations are driven by a value creation thesis, with benefits often arising from organizational redesign, procurement synergies, technology consolidation, or cross-selling opportunities. The IMO acts as the central authority on synergy tracking, frequently partnering with Finance to categorize costs and benefits accurately. It works with workstreams to quantify synergies, track their realization, and report progress to senior management.

- Integration data and document management: Integrations generate large volumes of sensitive documents and materials. The IMO serves as the single point of contact for all integration-related documentation, managing access rights and ensuring proper distribution. It is also responsible for designing and distributing templates, baselines, and other integration-related artifacts.

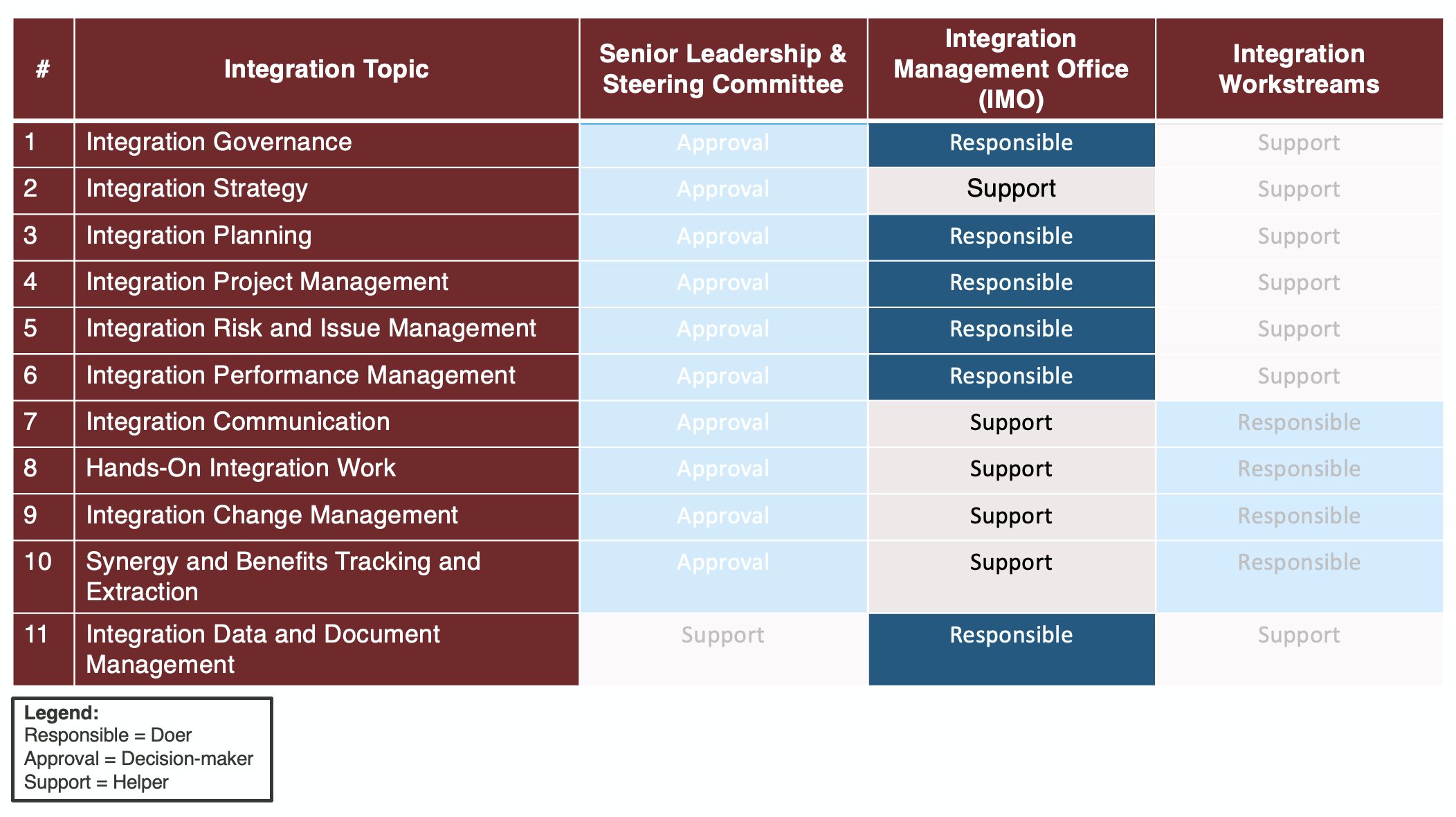

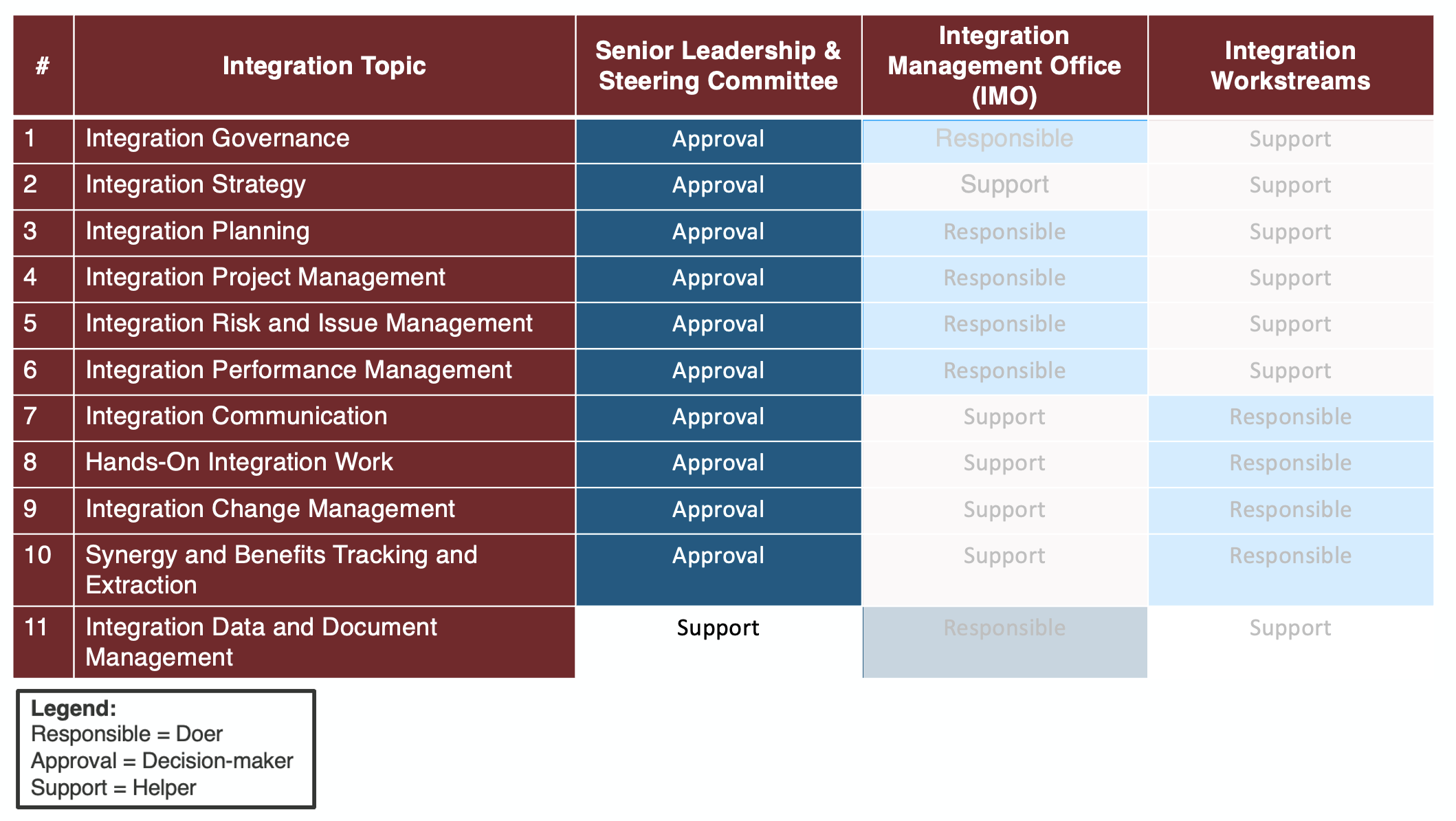

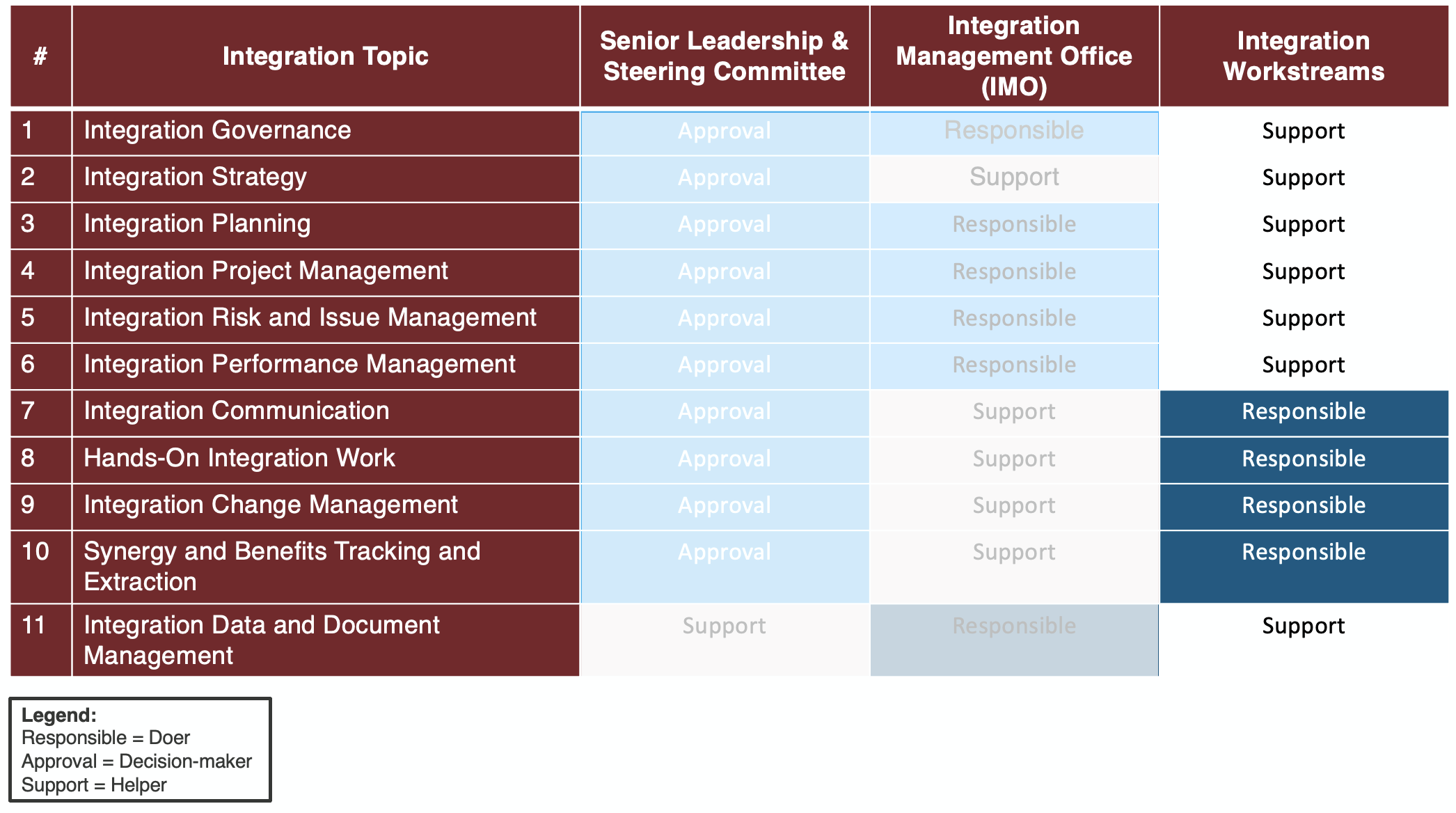

The table below summarizes the key responsibilities of the integration management office, along with other integration management bodies:

Post-merger integration team

The integration team, or post-merger integration (PMI) team, is an IMO structure encompassing several roles and teams that collaborate to execute an integration initiative. While the size of a post-merger integration team can vary depending on the project, the roles typically remain consistent.

Integration manager

The integration manager is a key individual responsible for completing the integration process. Typically, this role is filled by an internal resource fully dedicated to the initiative and possessing the necessary skills. These skills often include prior experience with integration processes, an M&A and consulting background, strong knowledge of the organization, and sufficient seniority to manage such a critical project.

In smaller integrations, the integration manager may also assume the responsibilities of a project manager. However, a dedicated project manager is usually required to support the initiative’s complexity in more extensive integrations.

Integration project manager

Even mid-sized integrations require tracking and completing hundreds of milestones and activities along the integration timeline. It is the job of the integration project manager to oversee integrated planning, monitor progress, and report on integration achievements while working closely with all workstreams.

The ideal project manager has experience with M&A integration projects, extensive industry knowledge, and strong project management skills. These skills include proficiency with project management tools and techniques that are not merely theoretical but grounded in a pragmatic, results-driven approach.

Integration analyst

An integration analyst is typically an internal resource who deeply understands the organization and its key stakeholders. They have access to all critical data related to the integration and can manipulate it, such as developing a baseline and compiling presentations. The integration analyst often supports the creation of integration templates, such as integration charters and data requests, which are then distributed across all integration workstreams.

External integration resources

Every integration requires considerable resources to be successful. Often, existing team members are already working at capacity and do not have the availability to take on additional integration work. A lack of integration experience and suitable resources may also be reasons for seeking outside help. External partners with M&A experience across various types of integrations and divestitures can be a key factor in making an integration successful. Below is an overview of when to consider using internal versus external resources for an integration.

Internal Integration resourcing

Addition of External resources

- Small integration

- Mid-size and large integration

- Availability of an integration playbook or the company has successfully integrated several times

- No integration playbook available

- Availability of strong senior resources with M&A experience to lead the integration

- No resources with sufficient relevant experience

- Sufficient internal resources to staff integration roles

- Organization is already busy and would struggle to resource the integration internally

- Existing tools and knowledge to deliver a successful integration

- No tools or experience to ensure a successful integration

Leveraging resources from the acquired company in the integration team

In some scenarios, including resources from the acquired company in the integration team might make sense. This typically occurs post-closing and may be influenced by specific deal constraints, such as a friendly merger rather than a hostile takeover. If included, these team members will be seen as part of the future integrated organization, and their involvement can bring meaningful benefits to the integration process. However, it is important to remember they will be exposed to all integration plans, which could involve sensitive information regarding their former team members, such as restructuring or downsizing the acquired organization.

Integration steering committee

Similarly to the IMO, in some scenarios, including an executive from the acquired company in the steering committee might make sense. This typically happens in very specific situations, such as a friendly merger or when an executive(s) is retained for the transition phase or has a place in the target organization—in other words, they are heavily vested in the success of the integration.

The integration workstreams are expanded to include key resources from the acquired organization, especially after closing. Ideally, these individuals will have a role in the target integrated organization, be subject matter experts in their respective areas, truly contribute to the integration, and be vested in its success.

The table below summarizes the key responsibilities of the steering committee, along with those of other integration management bodies:

Integration workstreams

Workstreams are responsible for the actual integration tasks. For example, in the procurement workstream, some tasks might include reviewing all contracts of the acquired company in detail, identifying savings opportunities, organizing sessions with vendors, negotiating better rates, and signing new contracts.

Apart from hands-on integration work, workstreams are responsible for change management within their areas, extracting synergies and benefits according to the value creation plan, and coordinating communication within the workstream (with support from the communication workstream).

The table below summarizes the key responsibilities of the integration workstreams, along with those of other integration management bodies:

Post-merger integration services

As mentioned earlier, an integration is often one of the most critical projects a company can face, making it essential to have the right integration team, capabilities, and tools in place. Most organizations lack this infrastructure since they don’t go through integrations regularly.

In such cases, finding the right external partner to provide post-merger integration services is crucial. Reliable integration services are delivered by an experienced team that has successfully managed multiple post-merger integration projects, ideally within your industry. The team brings relevant knowledge and tools, offering overall guidance, planning, and hands-on support for different workstreams.

If you’re about to embark on an acquisition/integration journey, contact us for an exploratory discussion to learn how our experienced team can offer integration services in this important endeavor.

Frequently asked questions

What exactly is an IMO, and when should a company consider setting one up?

An IMO is a temporary organizational unit charged with overseeing and managing a merger/acquisition (or carve-out) integration until the two organizations are fully combined as per plan. A company should consider setting up an IMO when the integration is large or complex — when multiple departments (HR, IT, Finance, Operations, etc.) must be coordinated, synergies are expected, cultural/structural changes are needed, or the integration spans over several months. In such cases, a dedicated IMO helps ensure coordination, accountability, and disciplined progress.

What types of roles and teams typically make up an IMO and what are their core responsibilities?

A typical post-merger integration team under an IMO includes: an integration manager (lead), often a project manager, an integration analyst, possibly other functional workstream leads (for HR, IT, Finance, etc.), and sometimes external consultants or resources if internal capacity or experience is lacking. Core responsibilities span governance (defining structure, roles, stakeholder alignment), planning (developing integration strategy and roadmap), project-management (milestones, timelines, coordination), risk/issue management, performance tracking (KPIs, synergies, costs/benefits), change management (communication, culture, training), and data/document management (templates, baseline data, documentation).

Can companies rely on their regular teams to handle integration or is dedicated resourcing (IMO) really necessary?

While it might be tempting to rely on existing teams, full-scale integrations usually demand more resources, focus, and coordination than everyday operations allow. A dedicated IMO, staffed by individuals with M&A experience and fully allocated to integration tasks, greatly increases the odds of success. This avoids overloading regular staff, ensures accountability, and brings a structured, disciplined approach to managing complex change across functions.

About the author

Alexey Saltykov

Our insights on M&A

Leading a Seamless Post-Merger Integration in Financial Services

Find out how we can support your mergers, acquisitions, and divestitures.

CONTACTS US