We work with private equity organizations to create tangible value

Private equity organizations look to create value throughout the deal cycle. Burnie Group has unique skills and experience to support these aspirations thanks to our unique approach to due diligence and value creation planning (VCP), and our focus on leveraging technology and innovation to drive incremental value.

Commercial due diligence: early in the deal cycle

Burnie Group’s commercial due diligence approach is focused and flexible. We follow a structured process to pressure test your investment thesis. Our approach helps build a robust fact base and allows funds to quickly make well-informed, confident investment decisions.

We adapt and tailor our approach to your specific needs and timelines. Our unique upper funnel due diligence leverages our engagement model to start early in the deal cycle to ensure PE clients are informed early and ready to act quickly when assets become available. Upper funnel due diligence offers you a significant head start when opportunities arise.

Burnie Group’s due diligence offers insights into the following areas:

Market Dynamics

- Evaluate the market size and expected future growth rate

- Understand the impact of the macroeconomic environment on the industry

- Identify industry trends (e.g., technology, regulatory)

Customer Insights

- Understand consumer preferences and consumption patterns

- Create distinct consumer segments and identify unique attributes

- Identify consumer trends (e.g., change in preferences)

Competitive Landscape

- Understand current industry players and their respective differentiators

- Identify possible gaps in current market offerings

- Evaluate how select competitors are performing

Growth Opportunities

- Learn about the target company’s capabilities and current operations

- Understand leadership’s planned initiatives

- Evaluate the universe of growth opportunities based on criteria (e.g., internal capabilities)

Burnie Group supports due diligence efforts along all pre-close phases, including deal sourcing, identified opportunities and shared teasers, receiving a Confidential Information Memorandum (CIM), and sending a Letter of Intent. In addition, we design flexible approaches for your specific needs.

Value creation planning & growth strategy

During our structured value creation planning process, we develop a rigorous bottom-up plan for your portfolio company to drive value through the asset lifecycle:

- Set priorities to capture value immediately and through the life of the asset

- Develop integrated, bottoms-up plans to execute

- Align leadership, deal team, and the Board of Directors

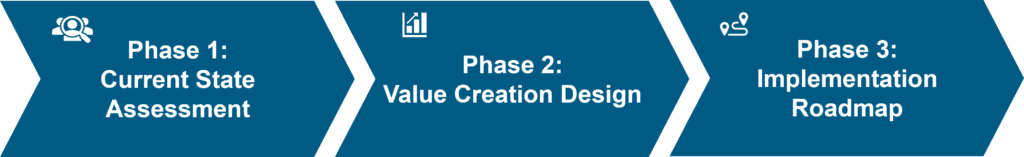

Burnie Group’s approach to value creation includes 3 phases. These phases help to identify key initiatives while developing a clear path to execution:

Phase 1: Current state assessment

- Align on strategic priorities

- Identify top opportunities for both revenue and cost

- Uncover potential immediate savings realized through quick wins

Phase 2: Value creation plan

- Define a mutually exclusive, collectively exhaustive (MECE) set of initiatives that fit your business model to deliver on the growth and profitability objectives

- Estimate return and resource plan for each prioritized initiative

- Define a system of KPIs and tracking for each prioritized initiative

Phase 3: Implementation roadmap

- Set up a successful execution of the value creation plan

- Develop an execution roadmap for each prioritized initiative

- Define ownership, accountability, milestones, timelines, and governance structure

- Develop a communication plan for change management

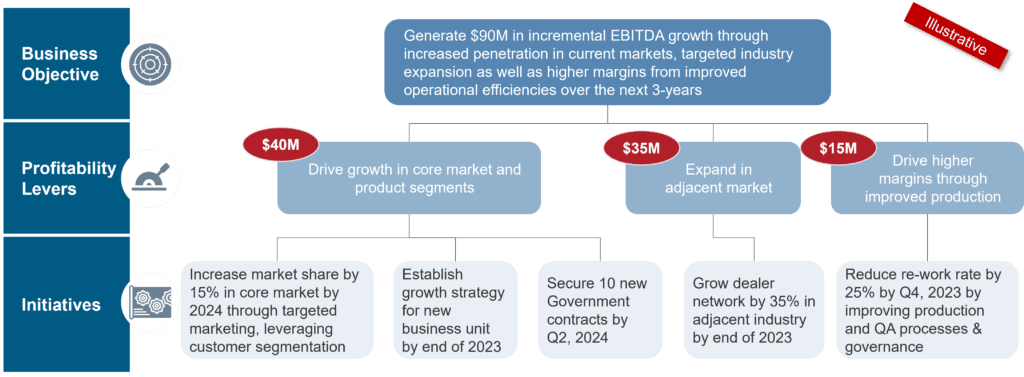

Using our value creation plan framework, we help you define business objectives, identify profitability levers to reach your objective, and plan and align specific initiatives for each profitability lever.

Learn more about how our consultants can support your business throughout the value creation process.

READ MOREPost-merger integration

Burnie Group has extensive experience in post-merger integrations for clients in various industries, company sizes and transaction contexts. As a result, we are well-positioned to be your valuable partner for PMI strategy, steering and support, and delivery and execution during all integration phases. Typical PMI projects we have successfully delivered for private equity portfolio companies include:

- Industry roll-ups

- Tuck-in acquisitions

- Mergers of two or more similar-sized organizations

- Carve-outs

Our unique PMI approach includes our PMI process library, integration management, reporting, and benefit tracking tools, integration sequencing planning, and integrated target state design.

Ongoing operations & value realization

Our operations excellence approach drives value and improves earnings (EBITDA) through continuous improvement across end-to-end operations. Our work addresses common challenges experienced by portfolio companies, including:

- Cross-functional processes with multiple stakeholders and many handoffs

- Processes that have evolved organically and are not well documented

- Operations with poor visibility, tracking, or governance

- Processes with unclear decision rights or multiple decision makers

- Processes where costly decisions are made due to a lack of control mechanisms

- Inadequate or ineffective use of technology to enable planning, scheduling, workflow, and tracking

- Outdated processes or operations

Our operating model framework provides a structured approach to evaluate current operations, prioritize improvement opportunities, and design the target state:

Examine the customer experience:

- Segmentation

- Customer journeys

- Relationship management

- Omnichannel experience

- Leads management

Examine key processes:

- Standardization

- Design

- Documentation (e.g., SOPs)

- Cycle of continuous improvement

- Application of frameworks such as Lean methodology

- Automation potential

Assess the use of technology:

- Application landscape – “right tools for the job”

- Workflow tools

- Workforce management

- Utilization

- Data collection & reporting

- Alignment to Technology roadmap

- Automation tools

Evaluate the people landscape:

- Organization (structure, size)

- Roles and responsibilities

- Skills, training and development

- Culture pulse check

- Capacity assessment

Assess controls and oversight:

- Work volume management

- Service level agreements

- Performance management

- Decision making & communication

- Reporting & transparency

We summarize your findings and create a roadmap for all identified operational improvement opportunities to prioritize and ensure successful implementation. Our value realization process results in more efficient and effective value realization for your portfolio company.

Learn more about how our management consultants can support your portfolio companies.

READ MOREPrivate equity clients we’ve worked with

Testimonials

“Burnie Group's team were great facilitators to help get us to the goal of the project.”

“Burnie Group's team did a fantastic job both explaining digital technologies and finding very relevant case studies to bring use cases to life for our team. Great material, great team, great value for money.”

Drive value across your portfolio with support from Burnie Group’s private equity consultants.

CONTACT US