Organizations typically use divestitures or carve-outs to focus on core operations or free up capital. A divestiture or carve-out typically has specific constraints, including the need for transfer service agreements and rigorous transition tracking. Our team provides a unique combination of deep expertise in these transactions, practical hands-on support, and exceptional value to the transaction.

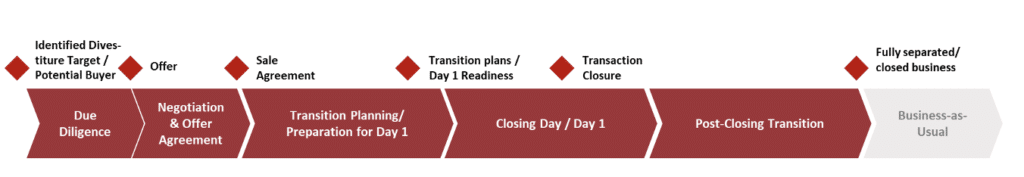

A typical divestiture roadmap with key milestones:

Divestiture consulting/carve-out consulting

When navigating the complexities of a divestiture or carve-out, you may be considering expert guidance tailored to your unique transaction. With our services, you will gain access to consulting services that support every phase of the process, from comprehensive Project Management Office (PMO) oversight to focused assistance across critical transition workstreams like HR, Finance, Technology, Operations, Marketing, Sales, and Communications.

With our help, you’ll benefit from a proprietary divestiture/carve-out database that contains thousands of proven transaction milestones and activities. This database is paired with the insights of experienced professionals who have successfully guided similar projects.

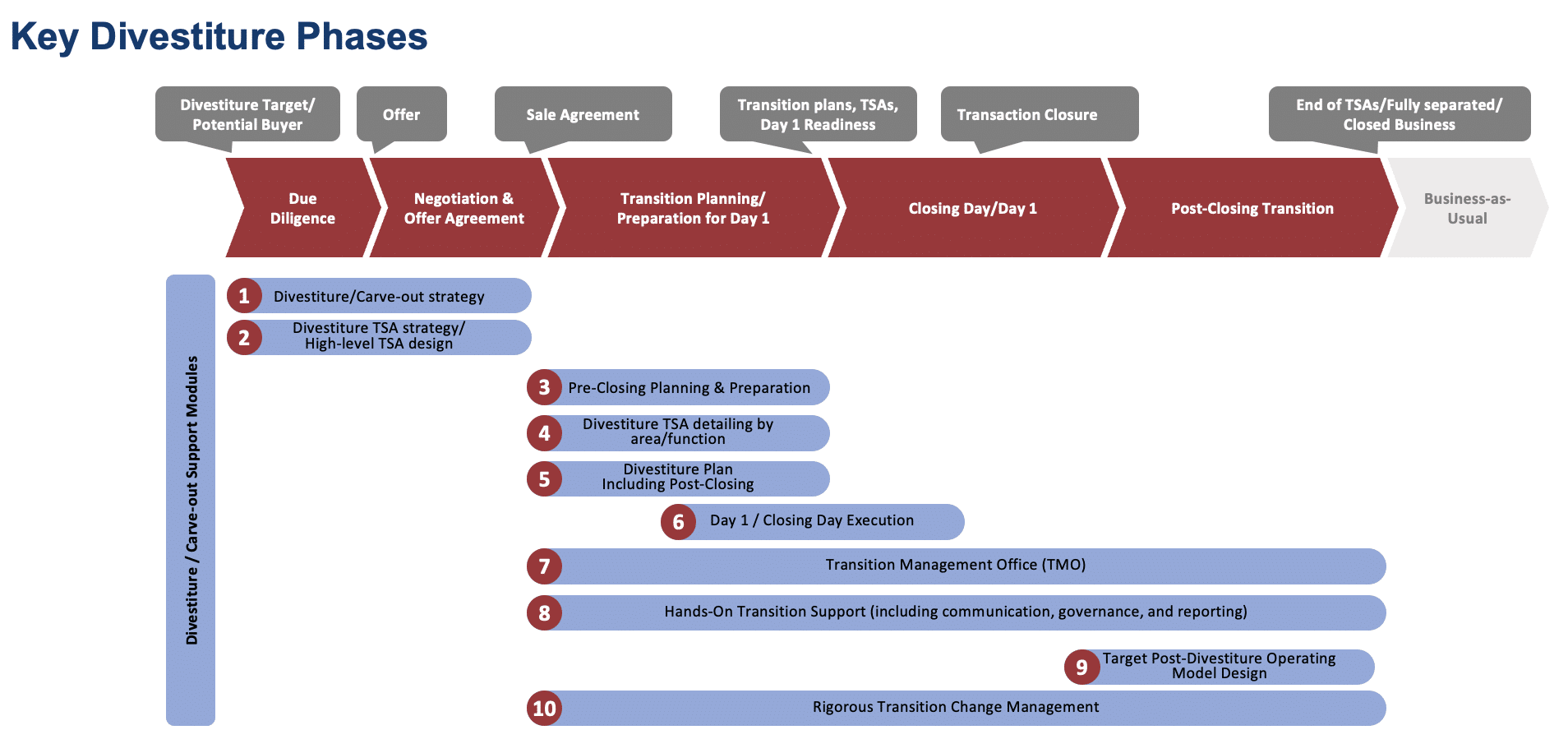

We support divestitures and carve-outs throughout the entire transaction cycle with ten divestiture/carve-out consulting services based on our divestiture framework, including assistance with the necessary divestiture Transition Service Agreement (divestiture TSA).

Divestiture/carve-out strategy

A properly designed divestiture or carve-out strategy is essential for a successful transaction and the associated value creation. Getting to the right deal pricing in a sale agreement requires an accurate evaluation of key elements in the divestiture or carve-out, such as a high-level outline of Transfer Service Agreements (TSAs), asset handling, and management of existing and potential business associated with the divested entity such as existing and prospective customers. Our team has extensive experience designing divestiture and carve-out strategies to help maximize deal value.

Divestiture TSA strategy/high-level TSA design

Transfer Service Agreements (TSAs) are essential to many divestitures and carve-outs. At a minimum, understanding the key divestiture TSA elements is crucial before finalizing the Sale Agreement and price. These elements include the areas covered by TSAs, types of services provided, duration, target service levels, transfer service pricing, and penalties for early or delayed exit from TSAs. We can support you in designing key elements of divestiture and carve-out TSAs, working closely with your legal team.

Pre-closing planning and preparation

A successful Closing Day and Day 1 are crucial to the overall success of a divestiture or carve-out, as they set the stage for a smooth transition. Our pre-closing transition planning and preparation cover the following topics:

- Developing the governance structure and approach for the divestiture or carve-out transition

- Setting up transition workstreams and teams to manage the divestiture

- Developing divestiture execution plans by workstream

- Establishing the transition service agreements (divestiture TSAs)

- Designing, preparing, and executing relevant transition communications

- Establishing transition oversight and reporting.

Divestiture TSA by area/function

One key step before Closing Day/Day 1 is the detailed design, negotiation, and signing of divestiture Transfer Service Agreements (Divestiture TSAs), which outline the services provided to a divested or carved-out unit during the transition phase until it is fully integrated into the buyer’s platform and operating model, which includes organization, processes, technologies, and governance.

Divestiture TSAs may be required for various areas such as HR, IT, and Operations. Detailing aspects like the scope of services, how they will be delivered, through which channels, acceptable service levels, tracking and governance mechanisms, and precise timing requires significant effort. Designing these elements can strain the team, which must also manage day-to-day operations. Our experienced consultants can assist with this process, ensuring TSA readiness for Closing Day/Day 1.

Divestiture plan, including post-closing

A divestiture plan must lay out a clear transition roadmap for your divestiture. Our transition planning includes:

- Developing pre- and post-closing transition plans by workstream, with key milestones and activities

- Leveraging an existing database of divestiture and carve-out activities to ensure no essential items are overlooked

- Identifying key decision points throughout the transition

- Identifying and defining interdependencies across various workstreams

- Incorporating Divestiture Transfer Service Agreements into the overall transition plan.

Day 1/closing day execution

In the case of a divestiture or carve-out, Closing Day/Day 1 is one of the most important dates, as the divestiture news becomes broadly known, impacting many employees. That is why it is crucial to meticulously prepare and execute Closing Day/Day 1, including communication with all key stakeholders.

It is also the day when Transfer Service Agreements (Divestiture TSA) often take effect, meaning a considerable part of the organization must operate differently. We will help you orchestrate many moving elements on this important day.

Transition Management Office (TMO)

A Transition Management Office (TMO) supports effective and efficient execution of transitions in divestitures and carve-outs. It serves as the main point of contact for all transition-related topics, overseeing the entire transition process and providing status updates on progress and value delivery. We can run or support your TMO by:

- Facilitating all transition-related touchpoints, capturing and helping to resolve transition questions

- Providing hands-on project management support for all divestiture workstreams

- Keeping divestiture transition processes on track

- Preparing and delivering divestiture status reports to senior leadership

- Maintaining and updating transition costs and benefits.

Hands-on transition support (including communication, governance, and reporting)

Managing a divestiture requires seamless support to handle the transition and ongoing business operations. By embedding experienced M&A consultants into your transition teams, you’ll gain the expertise to navigate every workstream effectively. Our consultants work alongside your team, helping you balance transition demands with daily responsibilities while ensuring no critical dependencies across workstreams are missed.

Target post-divestiture operating model design

Implementing divestiture changes post-Day 1 often requires redesigning the existing operating model, especially across support functions. We will work with you to design a transition operating model, including considering Divestiture TSAs, and define the target operating model using our unique operating model visualization methodology. The model reflects the dimensions of the customer, people, technology and tools, process, and governance.

Rigorous transition change management

Divestitures typically involve significant changes, especially with employees, that include organizational design and role evolution, transition positions, and employee transitions, and must be handled with the necessary attention, sensitivity, and proper communication. We work with you to ensure your leaders are prepared to plan and drive changes throughout the interim and remaining organization. Our change management work includes:

- Developing comprehensive change management plans

- Communicating and cascading changes throughout the organization

- Delivering necessary coaching across the organization

- Monitoring and visualizing change progress.

Divestiture/carve-out playbook

Some of our clients are in an ongoing acquisition and divestiture mode, especially in the private equity industry. We support clients who face recurring divestitures by developing a divestiture playbook for their organization. We validate these playbooks with our clients in real time. A typical divestiture playbook includes:

- Various divestiture scenarios for different integration types (size, type, geography, etc.)

- Transition governance for your divestiture

- Typical divestiture plans, including key milestones (with alternative options)

- Transition planning by workstream (Communications, Sales and Marketing, Product, Legal, Human Resources, Finance, Operations, Technology, and others)

- Operating model re-design approach for the remaining company

- Divestiture communication samples

- Divestiture change management

- Key divestiture artifacts

Our divestiture consulting differentiators

Our M&A expert team

Our dedicated M&A consultants have extensive post-merger integration and divestiture consulting experience from top consulting firms. Instead of switching consultants between engagements, our team can work with you on multiple transactions. In addition to planning and steering, we also roll up our sleeves and get involved with execution tasks.

Database of 5,000+ M&A milestones and activities

Our database of over 5,000 integration and divestiture activities and detailed divestiture checklists enables efficient planning at both high and detailed levels. You can select the milestones and activities relevant to your deal from our library, which spans various industries and functions.

Robust tools to support your divestiture

Our proprietary tools and divestiture framework guide your divestiture and track value creation, including dynamic transition worklists, transition dependency management, transition reporting, and more. Talk to us for a full overview of our divestiture toolset and our divestiture consulting capabilities.

Hundreds of sample communications

Save time and effort with our proven communication templates, including divestiture principles, overarching divestiture statements, CEO Day 1 announcements, and employee FAQs.

Technology decoupling support

One of the most complex transition undertakings is separating the technology backbone of the divested unit from the technology used by the remaining company. This often requires carefully designed and negotiated Transfer Service Agreements (TSAs). Our methodology covers all IT towers, including applications, data, infrastructure, end-user computing, IT security, and IT governance.

Divestiture change management

Our support focuses on numerous change management principles to ensure a smooth transition. Our divestiture and carve-out consulting includes day-to-day involvement and coaching for your leaders and teams.

Testimonials

“[Burnie Group] did a nice job getting to know our business and industry and honing in on issues and priorities.”

“[Burnie Group] engaged the right stakeholders, fully understood our business, and provided a very thorough step-by-step implementation plan for us to execute.”

Find out how we can support your divestiture or carve-out.

CONTACT US