Most integrations bring about significant change and managing that change proactively is essential to a smooth transition. For most employees and leaders, going through an integration is a rare, often once-in-a-career experience that demands hands-on guidance and support. When merger and acquisitions (M&A) change management is mishandled, the consequences can be severe: employee disengagement, operational disruptions, and lost enterprise value.

Unfortunately, we’ve seen that many organizations, and even experienced consultants, approach M&A change management (in particular, for post-merger integrations) without fully grasping its six critical elements.

Here’s what we’ve learned from supporting more than 20 integration projects:

Key takeaways

-

You can’t build a full change-management (CM) plan up-front; Change management must evolve with the integration

-

Successful M&A change management requires organizational-wide ownership, not just HR’s involvement

-

Too much change management at once can backfire

1. You can’t immediately build a comprehensive change management plan

Many organizations approach change management (CM) by developing a detailed CM plan at the outset of an integration and sticking to it. This approach is doomed to fail.

Why? Because when integrations begin, there’s rarely a clear picture of the future state. Key decisions, such as the target legal structure, branding, organizational design, and technology landscape, unfold gradually as integration teams delve into each organization.

A change management plan must evolve in response to these discoveries. While some activities should be planned immediately after close, such as Day 1 communications, the majority of CM activities will take shape as the integration progresses.

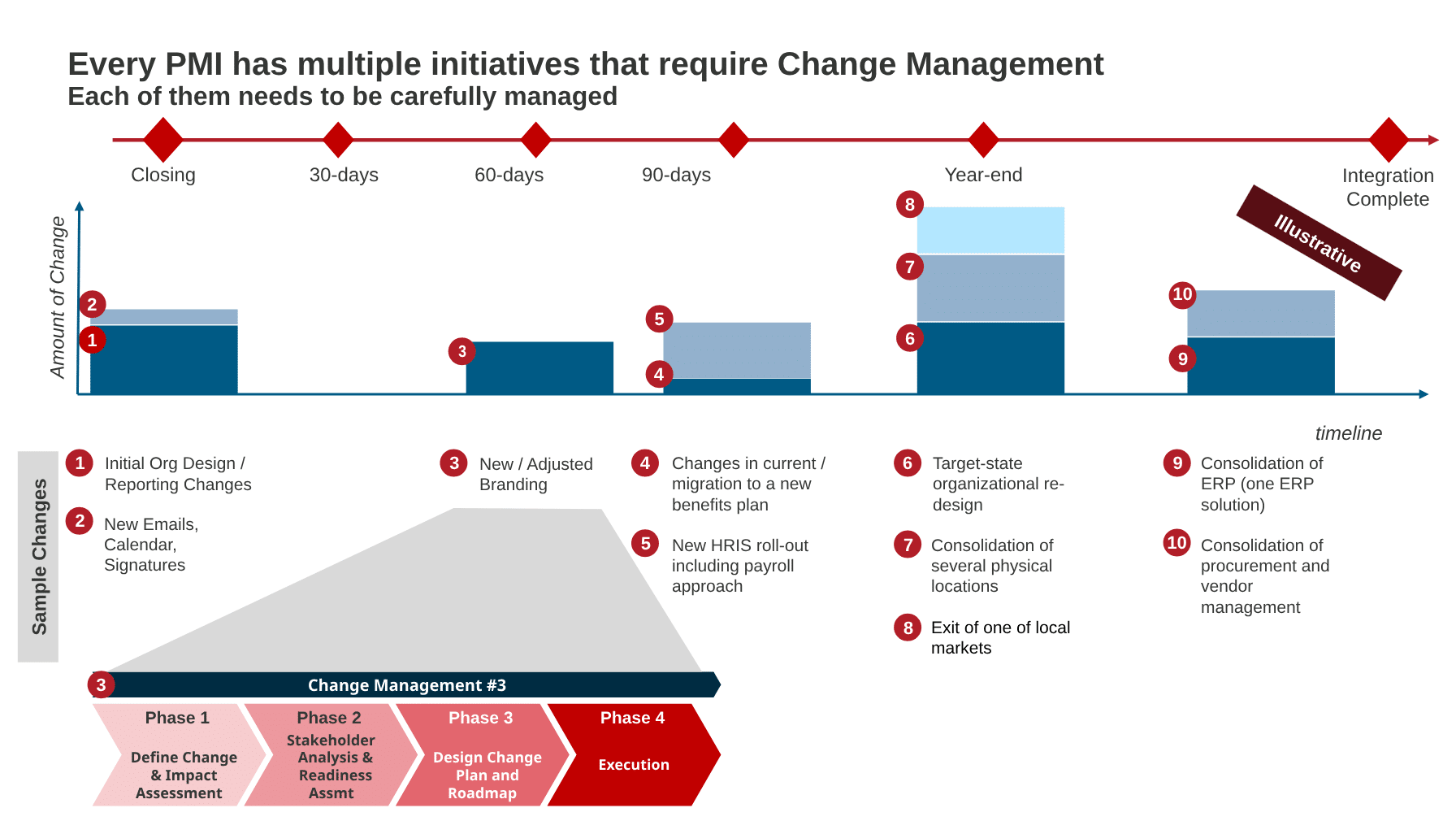

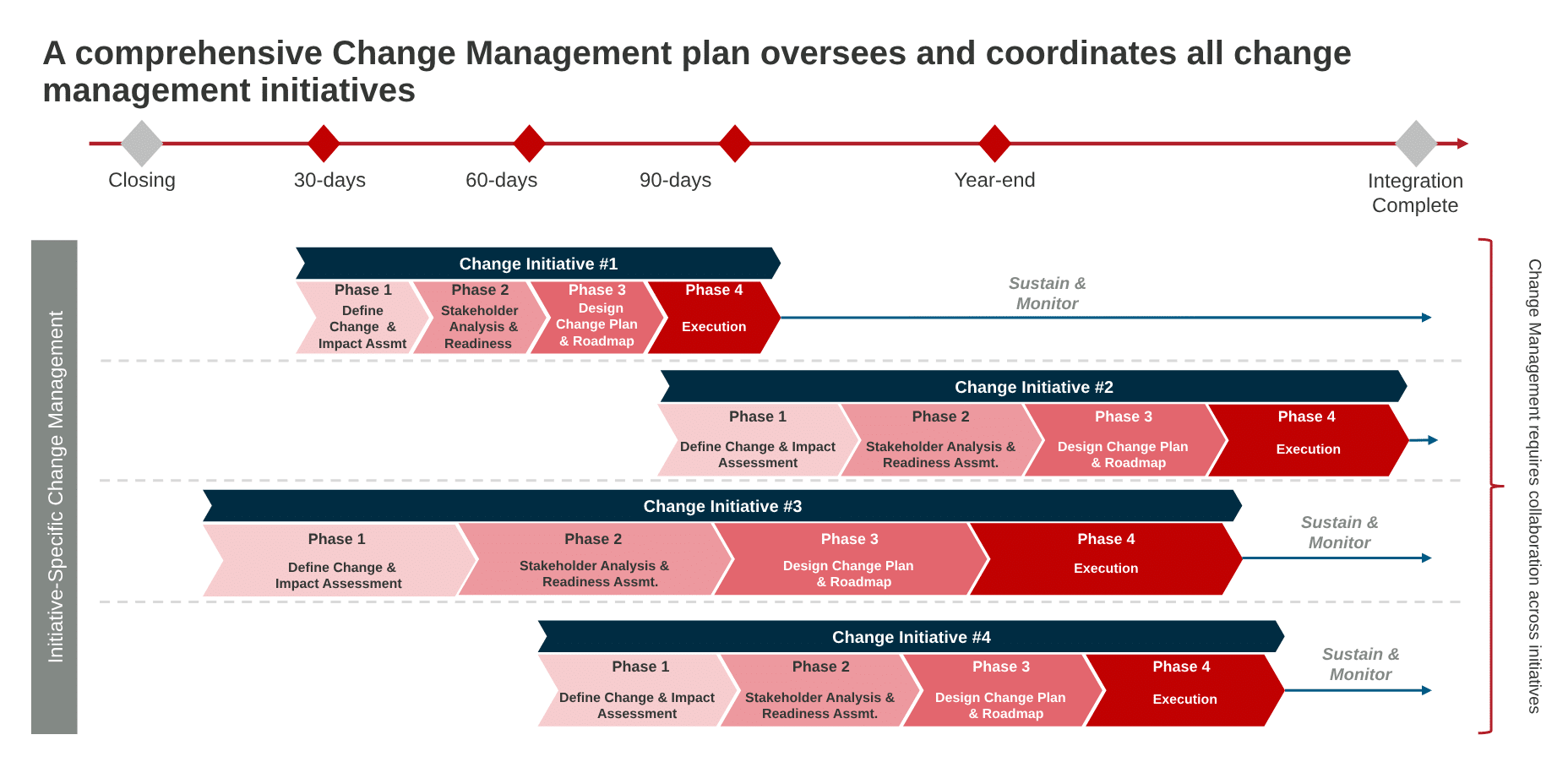

2. Change management through smaller, targeted plans

Because the future state evolves over time, so must the CM plan. Instead of a single monolithic plan, dozens of smaller CM initiatives should be designed, each with its own focus and level of complexity. For example:

- Day 1 rollout of a shared communication platform requires a plan for roll-out of a targeted set of collaboration tools, communication expectations and associated training.

- Brand consolidation, typically achieved within approximately three months, requires thoughtful change management efforts that focus on clients, employees, and partners.

- Implementation of the Target Operating Model, approximately six months after its introduction, must trigger change management efforts related to structural and role changes across the entire impacted organization, including associated processes and supporting technologies.

- ERP system migration at ~12 months requires detailed CM planning specific to process, training, and adoption of a new ERP solution by impacted teams.

Each initiative affects different stakeholder groups in unique ways and must be planned accordingly. It’s important to remember that change management doesn’t end at go live. To sustain behaviour change and drive long-term adoption, reinforcing mechanisms are essential. These include leader recognition, ongoing feedback loops, and follow-up training, all of which help embed the change into daily routines and organizational culture.

Change management activities should also be tailored to each stakeholder group, as things that resonate with one group of stakeholders (e.g., senior leaders) may not be effective for other groups (e.g., people managers or frontline teams). Each group experiences change differently and require a distinct level of messaging, tools, and support to ensure successful adoption.

3. Change management isn’t just HR’s job

Too often, CM is thrown on HR’s plate as just another task for them to manage. While HR plays a vital role, especially in training and learning, effective CM should be a company-wide effort.

It requires alignment across leadership, communications, IT, and business functions. Essential change management components include:

- Leadership role modelling

- Multi-channel communication across various stakeholder groups

- Training & development

- Pilots and phased rollouts

- Change ambassadors

- Cross-functional collaboration

- Robust change management methodology such as the Prosci ADKAR model (which we highlight later in this article).

We recommend establishing a dedicated CM workstream that partners closely with all other integration teams through the entire transaction.

4. Too much change management can hurt

Yes, you read that right—more CM is not always better. Some believe “you can never do too much change management,” but the reality is different. For employees, every CM activity adds work:

- Extra training

- More email communications

- Additional coaching sessions

- New rules and policies

- Extra alignment meetings

It’s crucial to remember that most impacted stakeholders will need to balance change management efforts related to integration with their day-to-day responsibilities, which can limit their capacity to absorb and adapt to the change.

Effective CM evaluates the total change burden on employees and bundles logically connected changes together, such as releasing a comprehensive HR policy pack rather than individual policies. This reduces fatigue and improves adoption.

In Learning & Development, for example, training should be coordinated and paced, and not a constant stream of new content.

5. Change management and culture are deeply connected

We’ve never seen two companies with identical cultures. That’s why culture must be addressed deliberately in integrations, especially when merging companies are of a similar size.

The importance of cultural integration is inversely proportional to the cultural gap between merging entities. In equal-size mergers, cultural alignment is crucial. In large-small acquisitions, cultural assimilation may be more straightforward unless the smaller company remains independent.

Our clients have found cultural assessments and organizational culture designs to be extremely helpful. These allow organizations to decide:

- Should we keep cultures separate?

- Should we merge cultures into something new?

- Should we design a transformative culture distinct from both?

6. Change management requires meticulous planning

Great change management must feel smooth and seamless, but that perception often comes at a cost. Behind the scenes, day-by-day planning of dozens of activities across multiple areas must be designed and executed.

In a recent integration, the following change management activities were implemented to support consolidation onto a single expense approval tool:

- Adding and validating approving manager data to the new expense tool

- Developing communications to be sent to the impacted managers

- Translating the communication into French

- Informing employees about the upcoming changes and scheduling training

- Scheduling training sessions and aligning on logistics, including virtual or in-person, trainer availability and more

- Designing training materials, including job aids

- Translating training materials and job aids into French

- Onboarding the impacted managers into the new expense management system

- Conducting training in English (offered in a couple of time slots), and recording it for later distribution

- Conducting training in French (also in multiple time slots), and recording it

- Distributing all materials and training recordings to participants

- Deploying support mechanisms for ongoing questions or issues including a hotline, contact details, downloadable guides

- Ensuring the new training and guidance are embedded into onboarding for future managers

- Capturing learnings from this mini-CM initiative to improve future efforts

Many of these activities happen just 1–2 days apart and require close coordination. That’s why meticulous planning and management of tactical change activities are critical, and why it often requires dedicated resources to deliver successfully.

Conclusion

M&A Change Management is one of the most important and most misunderstood areas in post-merger integrations. When done right, it smooths transitions, builds trust, and helps deliver on a deal’s realized value. When ignored or oversimplified, it risks derailing the entire integration.

If you’re planning an integration or just starting to explore the topic of M&A change management, such as a part of a post-merger integration, our experienced team would be happy to connect and share what we’ve learned. Connect with us today.

Frequently asked questions

Why can’t we just design one big change management plan at the start of the integration?

In most integrations, many key decisions (e.g. organizational structure, technology stack, branding, culture) emerge gradually as integration teams work through the deal. A rigid, up-front plan risks becoming irrelevant or causing misalignment when actual integration realities diverge from initial assumptions. Effective CM instead uses a sequence of smaller, focused plans that evolve as clarity emerges.

Who should own change management in a merger: is it HR’s responsibility only?

No. CM should be a company-wide effort, not just HR’s responsibility. Leadership, IT, business functions, communications, and other teams should be involved. Typically, a dedicated CM workstream is established to coordinate across all integration workstreams and ensure consistent, cross-functional execution.

Is it possible to do too much change management or should you maximize all CM activities to ensure adoption?

Yes. Doing too much CM at once can be counterproductive. Each CM activity (training, communications, new policies, meetings, coaching) adds load on employees, who often must handle these alongside their daily work. Effective CM recognizes this change burden, bundles related changes logically (e.g. policy pack rather than one policy at a time), paces training and communications, and avoids overwhelming staff, which increases the chances of successful adoption.

Our insights on M&A

5 Best Practices to Deliver Synergies in Post-Merger Integration

Find out how we can support your mergers, acquisitions, and divestitures.

CONTACTS US