As the year draws to a close, executives and senior leaders face the familiar challenge of meeting year-end budgets. A common scenario is the need to allocate unspent funds strategically to maximize impact while avoiding reductions in next year’s budget.

At Burnie Group, we see this every year. The best-performing organizations use this time to make “no-regret” investments that drive measurable results and position them for success in the year ahead.

Key takeaways

-

Invest remaining year-end budget in no-regret initiatives, such as process diagnostics, strategy refreshes, and customer studies to drive measurable results.

-

Focus on building long-term capability by preparing an integration playbook, reviewing your target operating model, and tackling structural or accountability issues.

-

Use year-end funds strategically, not just for spending, by aligning with your business priorities, setting the stage for growth next year, and avoiding rushed or ineffective investments.

Where executives invest at year-end

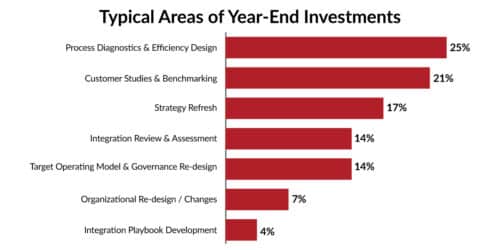

From our experience, executives prioritize initiatives that deliver immediate impact while building long-term capability. The most common investments include:

- Operational efficiency programs (~25%)

- Customer studies and benchmarking (~21%)

- Strategy refreshes (~17%)

- Integration review and assessment (~14% each)

Below are seven types of initiatives that consistently deliver strong returns.

1. Process diagnostics and efficiency design

Investing in process optimization and continuous improvement delivers fast, visible results such as lower costs, improved customer service, and higher quality. Even modest projects can produce meaningful gains that carry into the new year. It’s no surprise that many leaders view this as a “no-regret” investment.

2. Strategy refresh

While a full corporate strategy review may only occur every few years, most organizations benefit from an annual refresh. Adjusting strategic priorities in response to changing market, political, or technological conditions helps ensure continued relevance. A year-end strategy session also re-energizes leadership teams and sets a strong tone for the new year.

3. Customer studies and benchmarking

Deepening customer understanding is one of the smartest year-end investments. Insights from interviews, surveys, and needs assessments inform decisions across pricing, product design, and sales strategy, driving future growth and customer retention.

Benchmarking helps organizations compare performance against peers and identify opportunities to improve service quality, cost efficiency, and competitiveness across functions or channels.

4. Targeted organizational structure review

Year-end is an ideal time to review organizational structure and clarify roles and accountabilities. These targeted reviews, often focused on a specific business unit or function, help improve efficiency, decision-making, and accountability as we head into the new year.

5. Integration review and assessment

Post-merger integrations often leave unrealized synergies on the table. Year-end funds can be used to revisit those opportunities, assess what was missed, and design strategies to capture remaining value. Enhancing integration not only lowers costs but also creates a more seamless customer experience.

6. Integration playbook development

For organizations pursuing ongoing acquisitions, developing a formal integration or divestiture playbook is a high-return investment. A structured playbook accelerates future transactions, reduces risk, and ensures consistency across deals.

7. Focused target operating model and governance re-design

Some organizations use year-end to reassess their operating model across people, processes, and technology. Fine-tuning these elements improves efficiency, reduces costs, and strengthens customer service. It’s a strategic use of remaining budget that pays dividends in the year ahead.

In summary, year-end doesn’t have to be a scramble to spend. With a focused approach, it can be an opportunity to invest in initiatives that create lasting value by improving performance today and setting the stage for success tomorrow. If you have remaining year-end budget, contact us today to discuss smart ways to invest it.

Frequently asked questions

Why should I invest unspent budget now instead of waiting until next year?

Year-end investments help you address current gaps, refresh strategy, and build momentum for the next year, delivering immediate impact and long-term value.

What kinds of initiatives qualify as no-regret investments?

Examples include operational process diagnostics, customer or benchmarking studies, a strategy refresh, integration or operating model reviews, all of which produce tangible results and future payoff.

How do I ensure these investments don’t just consume budget without results?

Choose initiatives that align with your strategic priorities, establish clear metrics for impact, and plan for execution beyond funding, ensuring the effort lays the groundwork for future success.

About the author